What is EmaraTax?

To unify the tax administration and manage all tax regulations, the UAE Federal Tax Authority is about to implement a new integrated Tax platform called EmaraTax. This system mainly aims to enhance the user experience to access all the services online through simplified procedures. Users can access all the services like Registration, Return filing, Making payments, Obtaining refunds, etc. easily through this system.

Major Developments Through EmaraTax

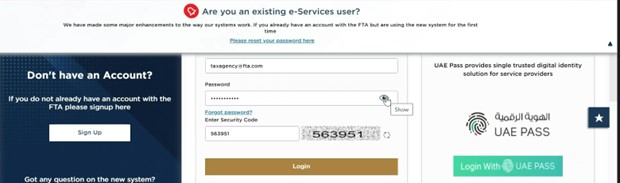

- Users can access the E-service portal using Emirates ID and UAE Pass (User Id and Password access are also available)

- Bank account details can be quickly updated in the portal using the Edit option which is currently updated through the filing of an amendment application.

- Reminder notifications will be sent to the user which will enable them to update their documents with FTA in time. (e.g.: expiry of Trade license, Passport/Emirates ID, etc.)

- EmaraTax introduces a new and efficient user interface to the Tax portal with below mentioned added features:

-

Payment Mechanism

- Under the Payments option, outstanding payments including penalties with a detailed description, tax type, and the period it relates to can be viewed. Payments can be made fully or partially towards multiple liabilities. It also gives much clarity on due dates and the status of liability or penalty.

- VAT payments can be made through MagnatiPay on EmaraTax.

- Users can pre-select within the system the liability or penalty to which they wish to make payment. Once the liability is selected, a unique 6-digit reference number will be generated. The Tax registrant must provide this unique reference code to process all the payments through Banks and Exchange houses.

- Advance payments can be specifically allocated in advance towards-

- a) Future VAT return liabilities, b) For settling outstanding liabilities if any. Currently, the excess payments are either adjusted against tax liability/administrative penalty/oldest liability.

-

My Correspondence

- Under my correspondence option, all communications related to submissions made with a reference number will be available.

- Certificates issued, NOC requests, Inquiry/ complaints history, and any communications related to Audit can also be viewed.

-

User Authorization

- This option enables the Authorized user to assign a Tax Agent or another user the right to access the portal.

- Details of Authorized users can be added and amended. New Tax Agent can be appointed on the same page. Authorization access can be Full access or Display access. The procedure for all this will be much easier than the current procedure.

-

Other Services

- Under Other services, users can view inquiries, complaints, waivers, reconsiderations, etc.

-

Additions to VAT Refund Procedure

A new layout for the VAT Refund application is designed in the EmaraTax portal for easy application and processing of the refund request.

- VAT Refund can be claimed against each VAT return filed in each tax period.

- The required information sheet can be filled out online in the VAT refund portal which was earlier attached in the VAT refund summary sheet.

- Upload supporting documents relating to VAT refund like invoices, official and commercial evidence, etc. separately in the online refund application with-

- 5 highest tax invoices from Standard rated expenses

- 5 highest tax invoices related to sales and other outputs

- 5 highest zero related supplies with their official and commercial evidence in case of exports.

-

Additions to VAT Return Filing

- As per the existing practice, the summary of the VAT return of a tax registrant is manually entered in the VAT return 201 Form online. With the implementation of Emaratax, VAT return excel template can be downloaded from the portal. This excel sheet can be filled offline and can be verified before uploading to the online portal. This method will ensure that no errors are happened due to technical glitch while filing the VAT return.

- Tax Refund provided to Tourists data can be downloaded from the portal and this data will be extracted from Planet Tax Free. The retailer should make sure that the data is accurate and complete.

- New tab which enables to view the payment status of each VAT return filed will be added in the portal.

The new platform EmaraTax will be launched later this year with the intention to digitalize the tax administration in the UAE. This system will simplify the online services and it will help the users to manage their tax obligations easily. The new system will provide the users a more transparent, faster, and easier approach towards the communications with the Federal Tax Authority.

Reach out for ECAG's wide range of Tax Services in the UAE:

CA.Ajil Varghese

Manager - Taxation

M: +971564709920E:

ajil@emiratesca.com

CA Navaneeth Mattummal

Manager – Abu Dhabi Branch

M: +971558892750

E: nav@emiratesca.com