UAE Corporate Tax Registration

At Emirates Chartered Accountants Group (ECAG), we understand the complexities of navigating UAE Corporate Tax Registration. The Federal Tax Authority (FTA) introduced Corporate Tax registration in the UAE through EmaraTax, aligning with Federal Decree-Law No. 47 of 2022 on Taxation of Corporations and Businesses ("CT Law"). Our tailored UAE Corporate Tax Registration service aims to make this process seamless for your business.

Who needs to register for UAE Corporate Tax?

Corporate Tax registration is mandatory for all taxable persons, including Free Zone persons and certain exempt persons, irrespective of turnover. Therefore, all of the following would be required to Register for Corporate Tax:

- Juridical persons (such as corporations) that are incorporated in the UAE

- Foreign juridical persons that are effectively managed and controlled in the UAE

- Non-resident juridical persons (foreign juridical entities) that have a Permanent Establishment in the UAE

- Non-resident juridical persons that have a ‘nexus’ in the UAE by virtue of earning income from Immovable Property in the UAE

- Natural persons who conduct Business or Business Activities in the UAE and have a Turnover of over AED 1,000,000 per Gregorian calendar year from such Business or Business Activities.

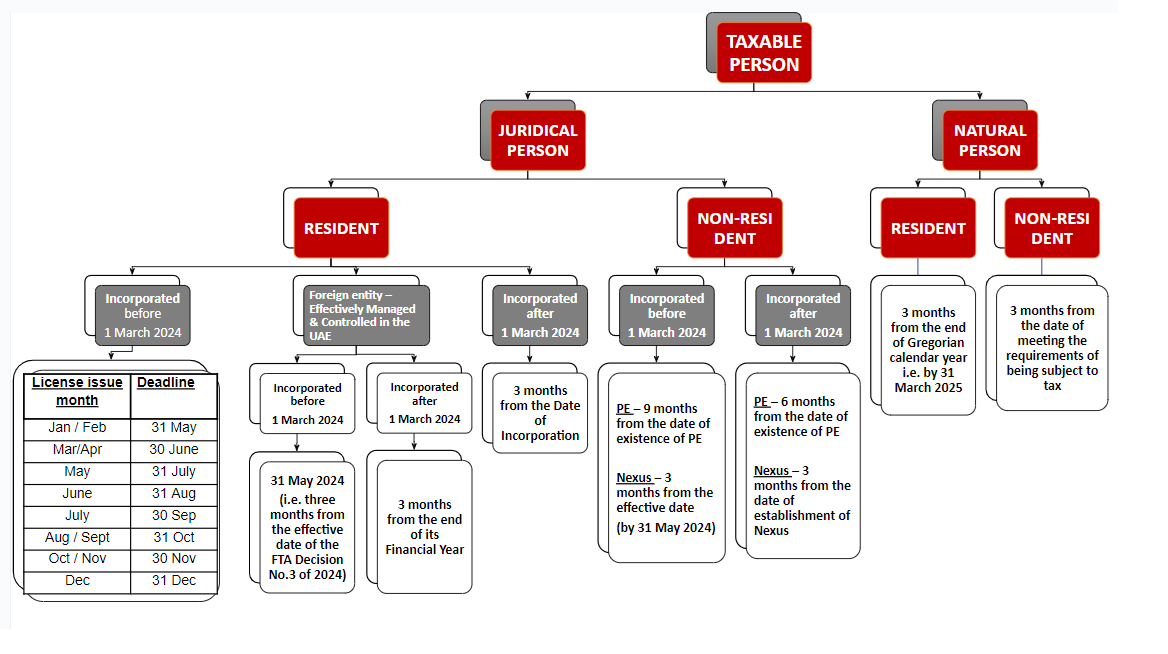

What is the Timeline for UAE Corporate Tax Registration?

The FTA has issued a clarification guide CTP001 on the Corporate Tax Registration Timelines which elucidates the different deadlines for different categories of taxable persons. The following diagram gives an overview of the timeline structure –

In the case of a missed deadline for registration by the tax payers, the FTA imposes a penalty of AED 10,000 per license.

What is the documentation requirement for Corporate Tax Registration?

The basic documents required to register are as under:

In the case of an applicant who is a Natural person

- Trade license, where applicable

- Passport and /or Emirates ID of the applicant

- In the case of an applicant who is a Legal Person

- Trade license, Memorandum of Association, Certificate of Incorporation, if any

- Passport and/or Emirates ID of all shareholders

- Passport and/or Emirates ID of authorized signatory

- Proof of authorization for the authorized signatory