Amendment in administrative penalties –UAE VAT

The Federal Tax Authority (FTA) has announced a reduction in penalties for businesses to file accurate tax returns by June 28, 2021. The UAE Cabinet issued Resolution 49/2021 to amend the provisions of Cabinet Resolution 40/2017 relating to administrative penalties imposed for violating tax laws in the UAE.

It comes as part of a proposal by the intelligent leadership to implement the tax system in line with the best standards that will ensure further growth of the national economy and achieve transparency and economic momentum, providing an appropriate and energetic tax legislative environment that promotes self-compliance.

The FTA said in a statement that the latest initiative to reduce 16 types of administrative penalties or amend the calculation method in accordance with Cabinet Decision 49 of 2021 on amending certain provisions of administrative penalties for violating tax laws. In the UAE, it is designed to assist tax registrars and help them meet their tax liabilities.

A late payment penalty will not be imposed on voluntary disclosures if payment is settled within 20 business days of submitting the voluntary disclosure.

The major highlights of this Cabinet Decision 49 of 2021

- The administrative penalty minimum is AED 500 and the maximum penalty is three times

- Existing penalties reduced

- New administrative mechanism

Some of the major amendments to the administrative penalties listed in the new resolution are as follows:

| Description | Penalty (New) | Penalty (Previous) |

| Failure of the taxable person to submit a registration application within the time limit | AED 10000 | AED 20000 |

| Failure of the registrant to submit a deregistration application within the timeframe | AED 1,000 monthly (not exceeding AED 10,000) | AED 10000 |

| Failure by the taxable person to display prices inclusive of VAT |

AED 5000 |

AED 10000

|

| Failure by the taxable person to issue a tax invoice/tax credit note. | AED 2,500 (for each instance discovered) | AED 5,000 (for each tax invoice) |

| Failure by the taxable person to comply with the conditions and procedures regarding the issuance of electronic tax invoices and electronic tax credit notes. | 2,500 (for each instance discovered) | AED 5,000 (for each tax invoice) |

| Failure of timely FTA update | 5000/10000 | 5000/15000 |

| Failure to inform the legal representative | 10000 | 20000 |

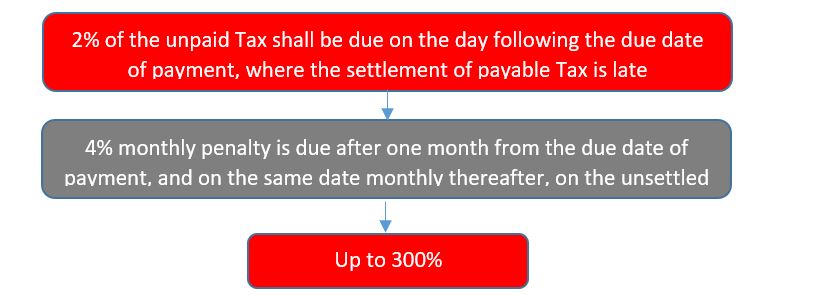

In addition, penalties based on the percentage applicable for late payment of tax - on a tax return or voluntary disclosure or assessment of tax - will be deducted and the 1% daily penalty previously levied will be waived.

The penalty of VAT –late payment

Non-Payment of VAT liability on the due date (28th day of the subsequent month)

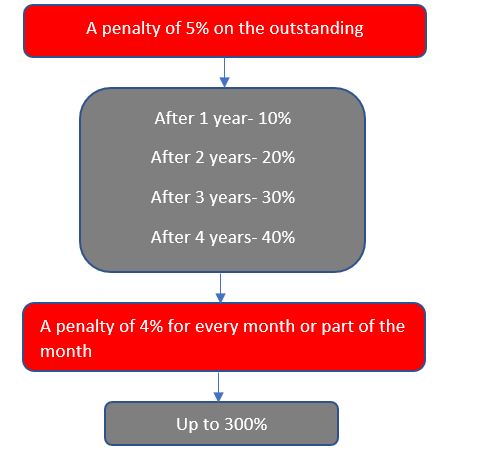

The failure of the person/taxpayer to voluntarily disclose an error in the Tax Return

There is a significant increase in the penalties where an error is corrected after the taxpayer is notified of an audit by the FTA.

| Penalty (Previous) | Penalty (New) |

|

30% of the unpaid tax after notification of the FTA audit 50% of the unpaid tax upon error discovered during an FTA audit |

50% of the unpaid tax along with 4% of the unpaid tax per month from the due date of the VAT return |

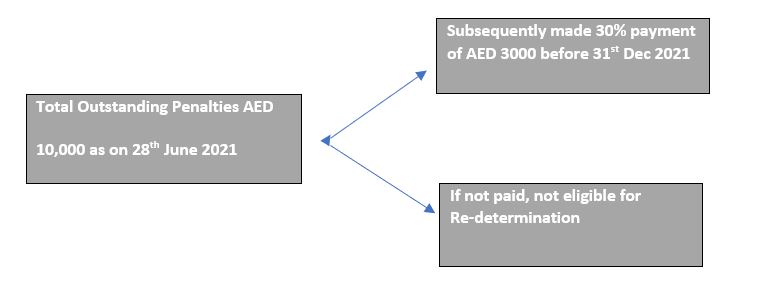

Redetermination of existing liabilities

Administrative penalties imposed on the tax registrar prior to the effective date of the new amendment for non-payment in full shall be re-determined by the FTA, which shall be equal to 30% of the total penalties where the registrant has paid all taxes due by 31 December 2021.

This exception is available only to the administrative penalties where 100% of the tax payable amount is settled before 31st December.

Conditions

- Fined under previous Cabinet Resolution No. 40/2017;

- The Registrar has paid all taxes by December 31, 2021;

- By December 31, 2021, the Registrar has paid 30% of the total administrative penalties due and unpaid, on the effective date of the new resolution.

The effective date of the new Cabinet Resolution

The new resolution will come into force sixty (60) days after its release on April 28, 2021, i.e. with effect from 28 June 2021.

Conclusion

Taxpayers can now benefit from the reduced administrative penalties that apply, especially when amending VAT returns submitted prior to adjusting for errors or omissions.

The period for filing the associated voluntary disclosures will determine the penalty based on the applicable percentage. These amendments provide an incentive for businesses to review their historical filing state and voluntarily disclose any errors before reporting an audit.

The first general clarification outlines the basic amendments to administrative violations and penalties related to the application of federal law for tax procedures to ensure the correct application of these amended penalties.

The second general clarification explains the mechanism used to re-determine certain administrative penalties imposed before the new amendment came into force on June 28, 2021.

Looking for TAX Services in the UAE?

We provide:

For Tax Services in Dubai:

Mr.Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr.Navaneeth

nav@emiratesca.com

+971 – 558892750

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115