What is Value added TAX and How is it calculated?

Value Added Tax is a type of general consumption tax that is collected incrementally, at each stage of production or distribution. It is also known as the consumption tax. VAT is a new concept for the region which shall be implemented across the Emirates from 1st January 2018 and will be applicable for all trading companies in the UAE. With the latest developments on VAT in the UAE as issued by the Federal Tax Authority (FTA) VAT registration process for taxable businesses has already taken its course of action. While VAT shall be applicable all over the UAE from 1st January 2018 at a standard rate of 5 percent

Let us have an overview of different scenarios on UAE VAT for Trading Companies.

If goods are sold by the trading companies before 1st January 2018, but it is delivered (includes transportation) or made available (when transportation is not included) after 31st December 2017. VAT in the UAE will be applicable over such supplies. Transitional rules refer to those kinds of transactions which is going to overlap for both the periods i.e. period before and after vat implementation. For example, let us take the following scenarios covered under the transitional rule:

Scenario 1:

If the payment is received with respect to the supply of goods or services before the introduction of VAT in UAE i.e. before 1st January 2018, but the goods or services are delivered after the introduction of VAT i.e. after 1st January 2018. For such kind of supplies, VAT must be charged.

Scenario 2:

If a contract is concluded prior 1st January 2018 to the introduction of VAT in UAE with respect to a supply which is wholly or partly serviced/supplied after the introduction of VAT i.e. after 1st January 2018. For such kind of services/supplies VAT needs to be charged.

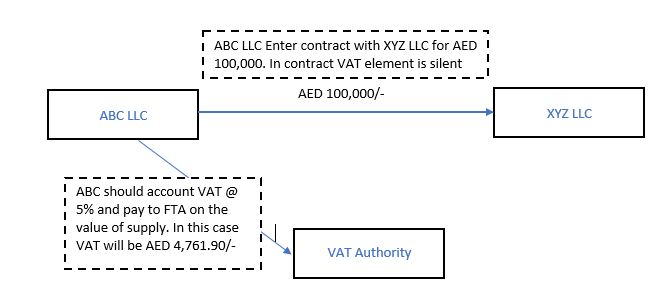

- If the contract is silent on the treatment of VAT, the value of supply will be considered as Inclusive of tax.

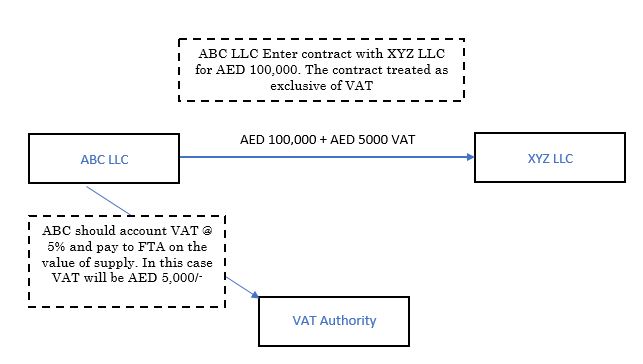

- If the contract states the treatment of VAT,the value of supply will be exclusive of tax and tax will be collected over and above the value.

- Where XYZ LLC is registered for VAT and entitled to recover VAT on their cost incurred, ABC LLC can treat the contract as if the price stated was exclusive of VAT.

- ABC LLC can, therefore, charge VAT to XYZ LLC in addition to the price stated.

Emirates Chartered Accountants Group provides full-fledged Tax Services in the UAE. We have extended our TAX services across the Emirates – Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman & Umm Al Quwain to SMEs, Micro levels & Corporate Groups. For VAT Registration, VAT Training, VAT Implementation, VAT Return Filing Services please do not hesitate to contact our below representatives

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115