VAT Administrative Exceptions You Can Apply In The UAE

The Federal Tax Authority (FTA) in the UAE released a recent guide providing the procedures and scope for certain exceptions from VAT procedures. The eligible registrants for VAT in UAE can thus apply for certain exceptions in the requirement for raising Tax Invoice, Tax credit note, converting the quarterly return to half-yearly, change in stagger (month forming part of the VAT return period), relaxation to supporting documents to qualify for zero-rated exports and can request to extend the time period of exports subject to time frame mentioned in the law. To summarize a VAT in UAE registrant can apply for certain administrative exceptions for the below-mentioned categories:

- Tax Invoices & Tax Credit Notes

- Length of the Tax Period

- Evidence to prove the export of goods

- Time for the export of goods

Elaborative Description on each administrative exception under the UAE VAT

1.Tax Invoice, Tax Credit Note

On producing enough reasons to support the request with valid documents required, the applicant may be allowed permission for not mentioning certain requirements as required for Tax Invoice and Tax Credit note (as required by Article 59 and 60 respectively of the Executive Regulation) or may be allowed not to raise these documents. Currently, a company completely performing zero-rated supplies or having completely zero-rated supplies in a transaction are directly eligible for an exception from raising Tax Invoice. In such scenarios, the company can raise commercial invoices. With this new exception, different businesses in the UAE can apply for relaxation based on the type and nature of the business to which the Federal Tax Authority (FTA) will review and based on which will provide their decision for compliance.

2.Length of the Tax Period

VAT in UAE registrants can request for following changes with respect to their current Tax Period-

- Change of stagger

- Change of period

- Change of stagger:

Stagger refers to the respective period for VAT Return Filing in The UAE

For example

A company registered in January 2018 having VAT Return Filing for the period January to March where the return to be submitted within 28th of April the staggers will be as follows:

01/01/2018 - 31/03/2018: Stagger is mentioned as VAT reference number 04 – 2018 in the VAT portal.

01/04/2018 - 30/06/2018: Stagger is mentioned as VAT reference number 01 – 2019 in the VAT portal.

*Stagger changes for each registrant. In short, stagger is the months forming part of a VAT Return Period. Where a company is facing difficulty in matching and filing the VAT Return.

For Example:

If a company is having an audit period from January to December, and VAT return filing period comprises of December- February, it becomes difficult for the accounts department where if only a single person is the accountant to perform audit requirements and VAT requirements simultaneously. So, the company can request for a change in the months required for filing VAT return stating the practical difficulty with valid reasons and supporting for the claim.

- Change of period

A VAT in UAE registrant can request for changing the time period to half-yearly i.e. the tax period of six months if the registrant is:

- Individuals such as board members, property owners and freelancers

- Business in a constant refund position

- Small and medium enterprises (SME) with official funding approved by any government entity where taxable supply for the previous 12 calendar months was equal or less than AED 9million.

Such VAT in UAE registrants who do not often make taxable supplies, or if their only taxable income arises once a year or half-yearly and their VAT 201 submitted is either nil or in a refund position are generally more probable for obtaining this exception to file VAT return from quarterly to half-yearly from the authority.

3.Evidence to prove export of goods

There have been many practical scenarios due to operational procedures some business were not able to obtain official and commercial documents to support the export of goods to qualify for VAT in UAE at zero rate. With this recent update from the FTA, the registrant can request to FTA for alternative documents as evidence to prove the export of goods

4.Time for the export of goods. As per Article 30 of the Executive Regulation for direct and indirect export to qualify zero rate VAT in UAE the export should be done within 90 days of the date of supply. In this VAT administrative exception, on valid grounds, the FTA can extend this 90-day period based on the request by the registrant.

Who can make the request?

The request can be submitted by either-

- The authorized signatory of the registrant.

- The registrant’s appointed Tax Agent; or

- The registrant’s appointed Legal Representative.

- If you are a member of a Tax Group, the request should be submitted by the Representative Member of the Tax Group.

How to make a request?

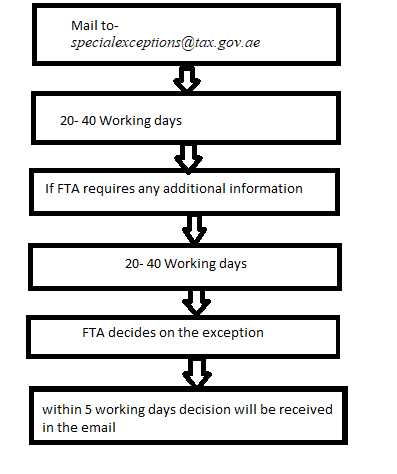

The request can be submitted through email to specialexceptions@tax.gov.ae

What is the Timeline for processing the request?

The Emirates Chartered Accountants Group are the registered Tax Agent with the Federal Tax Authority under Emirates International Chartered Accountants Group. We are happy to support and guide your company for any of the above-mentioned requirements. Our Tax Professionals are highly qualified and well versed with the UAE Tax Law with the practical implementation of VAT in UAE and Bahrain. We understand that every business is different from the other. Hence, each of our services is tailored as per your business needs.

Looking for TAX Services in the UAE? We are happy to assist.

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Navaneeth

nav@emiratesca.com

+971 – 558892750

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115