Extension of VAT Return Due Date By FTA In The UAE

Extension of VAT Return due date is the latest update that came from the Federal Tax Authority, on 21st April 2020. Taxpayers in the UAE were eagerly waiting not only for the extension of the VAT Return due date but also an extension of the VAT payment due date, at least for a period of one month.

The Federal Tax Authority in its efforts to battle the Global pandemic, COVID-19, has been taking unparalleled measures for ensuring the continuity of businesses across the region with minimal hindrance.

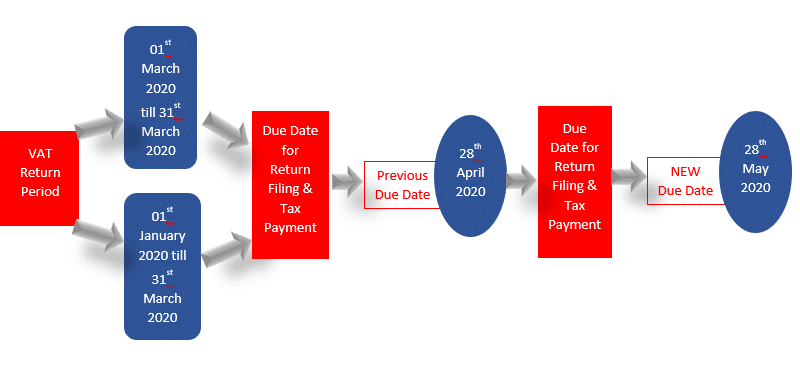

Understanding the need of the hour, on 21st April 2020, the Federal Tax Authority has announced an extension of VAT Return filing due date for the quarter/month ending on 31st March 2020. The extension of the VAT Return due date for this tax period has been made to 28th May 2020.

Along with that the due date for VAT payment also extended to 28th May 2020. Generally, the 28th of every month marks the due date of VAT return filing in the UAE. Basically, April 28th was the due date for businesses having a monthly tax return for the month of March 2020. Those registrants who have tax period on a quarterly basis which ends on 31st March 2020 also marked the due date as 28th April 2020. However, the new announcement of the extension of the due date for VAT Return Filing along with the extension of the due date for VAT payment is going to help such both categories of registrants.

Is there any penalty due to the extension of UAE VAT Return filing?

This decision of FTA to extend UAE VAT return due to date aims in helping businesses to cope up with the cash flow impacts due to business lockdown caused by this pandemic.

A tax registrant can file the returns, which were originally due on or before the 28th of April 2020, by 28th of May 2020 without incurring any non-filing penalty.

Generally, if a tax registrant fails to file his tax returns on or before the due date, he shall be liable for a non-filing penalty of AED 1,000 for the first time and AED 2,000 in case of recurrence.

But, considering the nature of circumstances, FTA has extended the VAT return filing due dates without any penalty on non-filing. The registrant can file the VAT return for the tax period ended March 31st up until the 28th of May 2020 without incurring any additional cost whatsoever.

How to File the Tax Returns during the period of extension?

In the case of registrants who are subject to monthly tax return filings, two separate returns need to be filed on or before the 28th of May 2020. One tax return pertaining to the tax period ended on 31st March 2020 (for the month March 2020) and the other for the tax period ended on 30th April 2020 (for the month April 2020).

Registrants need to submit the data of each month in its respective return and are not to consolidate the figures in one tax return. For the registrants who are subject to quarterly tax return filings, the tax return for the period ended 31st March 2020 can be filed on or before 28th May 2020. Please note that the extension applies only to the time frame of filing the returns and not to any procedural aspects of filing the return, which remains unchanged.

When to make the payment? Is there any penalty if the tax payment is not done in April 2020?

The Federal Tax Authority through its notification on the extension of the due date of UAE VAT return and extension of VAT payment due date, notified the registrants to ensure that payments/tax liabilities shall be honoured latest by 28th May 2020. In normal case, if there is any delay in paying the VAT liability for one month would have resulted in a penalty of 6% (sum of 2% for the first 7 days, 4% for the following 23 days) for the taxpayer.

The extension of the due date for paying Tax liability option put forward by the FTA is intended to reduce the tax burden on taxpayers and gives ample enough time to manage the cash flows and finances of the businesses in UAE.

The new notification on the extension of VAT return filing and extension of VAT payment is truly an ‘exceptional’ move undertaken by the UAE government and FTA. At the same time, all taxpayers should keep in mind that the waive off of penalty is applicable only for VAT liability arising for the specified VAT returns only. If you had not settled any payment related to any previous period returns, don’t expect a waive off from this announcement.

Extension of Excise Tax Return filing due dates & payment

It was on April 14th, 2020 that the FTA declared an extension of Excise Tax Return filing due dates for March 2020 by one month. The previous due date was 15th March 2020 and is extended to 17th May 2020. This step was welcomed by all the major business houses in the country.

But even after such a drastic measure to boost the economy, business communities in the country were hoping for an extension of VAT Return due dates as tax net of VAT is much wider than that of Excise tax. From its inception in 2018, VAT is playing a pivotal role in the cash flow mechanisms of virtually every sector in the country.

Emirates Chartered Accountants Group takeaways on the Extension Notification

We, Emirates Chartered Accountants Group, lauded the efforts taken by the authorities to support the businesses in the region. As a professional firm, we strongly believe that these measures can truly impact the industries in the region, especially the SME sector.

We, from our immense practical experiences from the industries, will recommend that the businesses can opt to file their tax return well within the normal due date (28th April 2020).

The extension of VAT return filing is mainly intended to curb down the cash flow issues a business might face during these tiring times. So, even when the payments can be made at a later date (on or before 28th May 2020), it is advisable to file the tax returns in its normal due dates as it will help in reducing the workload of filing two tax returns, especially for registrants who have a monthly return filing.

We, Emirates Chartered Accountants Group, stand by all our users during these rough times and are always dedicated to notifying the current economic updates in the region.

Looking for Tax Services in the UAE? We are happy to assist.

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Navaneeth

nav@emiratesca.com

+971 – 558892750

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115