- May 16,2020

- ESR UAE

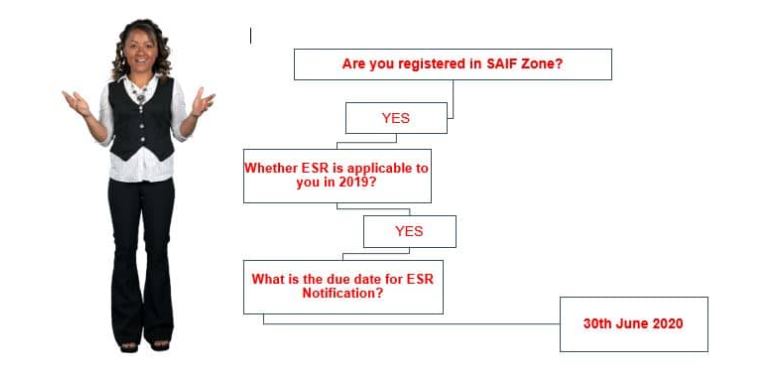

ESR SAIF Zone Notification Deadline – 30th June 2020

Economic Substance Notification (ESR Notification SAIF Zone) Deadline - Sharjah Airport International Free Zone (SAIF Zone) is one of the Regulatory Authority in the Emirate of Sharjah, as per the Economic Substance Regulation UAE (ESR UAE). SAIF Zone Authority also published the due date to file the Economic Substance Notification (ESR Notification SAIF Zone). All the licensees who are falling under the Economic Substance Regulation UAE (ESR UAE) must file the notification on or before 30th June 2020. This deadline for submitting Economic Substance Notification (ESR Notification) is for the financial year 2019.

Which Licensees are governed by Economic Substance Regulation (ESR)?

The licensee conducting the Relevant Activities are governed by Economic Substance Regulation UAE (ESR UAE). Both the Licensed activities (activities mentioned in Commercial/ Trade License or Memorandum of Association or Certificate of Incorporation or any permit/document issued by licensing authority), as well as Actual activities, are to be assessed for applicability of Economic Substance Regulation UAE (ESR UAE). Hence you should take substance over form approach for determining whether the Economic Substance Regulation UAE (ESR UAE) is applicable for you or not.

What is Economic Substance Regulation (ESR)?

Economic Substance Regulations (ESR) vide Cabinet of Ministers Resolution No 31 of 2019 is effective in the UAE from the year 2019. This Regulation is applicable to all companies registered in the UAE onshore & Free Zone (including Financial Free Zone) carrying out Relevant Activity. The businesses in the UAE will now have to prove their Economic and Substantial existence in the UAE and have to apply the substance over form approach. As per Article 8 of this regulation the Licensees need to file Economic Substance Notification (ESR notification) and Economic Substance Return (ESR Return) with its Regulatory Authority within the declared due dates.

What are Relevant Activities under Economic Substance Regulations UAE (ESR UAE)?

As per Cabinet Resolution No. 31 of 2019, Relevant Activity means following:

- Banking Business

- Insurance Business

- Investment Fund Management Business

- Lease-Finance Business

- Holding Company

- Headquartered Business

- Shipping Business

- Intellectual Property Business

- Distribution & Service Centre Business

So, the entities must notify (Economic Substance Notification- ESR Notification) the Authority whether or not they carry out any of the above mentioned Relevant Activity. Whether the licensee carries out the Relevant Activity or not needs to be assessed by the licensee. Regulatory Authority SAIF Zone Authority is not responsible to do any assessment on the applicability of Economic Substance Regulations UAE (ESR UAE). Further, it is to be noted that if the Licensee is carrying out the activities which are not mentioned in the license issued by SAIF Zone but in substance falls in the category of Relevant Activity, the licensee will have to notify (Economic Substance Notification -ESR Notification) to the Authority that it is carrying out the Relevant Activity.

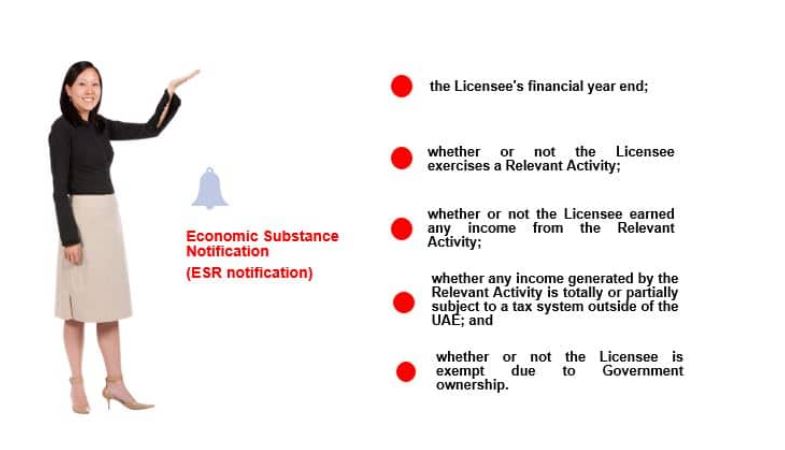

What is to be notified?

As provided in the circular issued by SAIF Zone Authority, Entities governed by the Economic Substance Regulation (ESR) need to submit a notification (Economic Substance Notification- ESR Notification) with the authority. The details in Economic Substance Notification (ESR notification) may include the following:

- the Licensee's financial year-end;

- whether or not the Licensee exercises a Relevant Activity;

- whether or not the Licensee earned any income from the Relevant Activity;

- whether any income generated by the Relevant Activity is totally or partially subject to a tax system outside of the UAE; and

- whether or not the Licensee is exempt due to Government ownership.

What are the penalties in cases of Non-compliance for Economic Substance Notification?

If any licensee fails to comply with the requirement of filing the Economic Substance Notification (ESR Notification), then such Licensee may have to face Penal Consequences as provided in Article 11 of the Cabinet Resolution No. 31 of 2019. The penalty ranges from AED 10,000 to AED 50,000 in the first year of its Non-Compliance and for Subsequent non-compliance, it ranges from AED 50,000 to AED 300,000. Further, failure by an Entity to comply with Regulation can also result in Spontaneous Exchange of Information with Foreign Competent Authority and potential suspension, revocation, or non-renewal of its registration.

How can Emirates Chartered Accountants Group support you?

We, Emirates Chartered Accountants Group have a specialized team on the Subject to support and guide you on the Compliance with Economic Substance Regulation with the following roadmap:

Phase I:

To study your Business Activities in detail and assess the applicability of Economic Substance Regulation (ESR) on your activities. Also, to provide support and guidance on filing Economic Substance Notification (ESR Notification) with the SAIF Zone Authority.

Phase II:

To provide the guidance and support for compliance with the provisions of the Regulation, if your activity is falling under the regulation. To conduct Impact Study and Gap Analysis in order to assess whether the Business meets the Compliance test and to provide the recommendations.

Phase III:

Economic Substance Reporting/Declaration with SAIF Zone Authority on or before the Due Date. Economic Substance Regulation in the UAE is applicable to all companies registered in the UAE, onshore & Free Zone (including Financial Free Zone) carrying out Relevant Activity. For Business entities registered in Sharjah Airport International Free Zone (SAIF Zone), in accordance with the Economic Substance Regulation in the UAE, businesses who are governed by the Substance Regulation must file the Economic Substance notification on or before 30th June 2020 for the financial year 2019.

If businesses are falling under the entities with the above-mentioned “Relevant Activities” in the UAE, then businesses should determine the applicability of Economic Substance Regulations in their business and should analyze the implication of this new regulation in the UAE.

At Emirates Chartered Accountants Group, we have quality-driven professionals who are well versed with practical knowledge of assisting businesses with the applicability of Economic Substance Regulation in the UAE & Bahrain. They shall help you determine the applicability of this law and support you with Economic Substance Notification for your business.

For your enquiries on Economic Substance Notification in JAFZA

Contact Persons:

CA. Manu Palerichal

Email: manu@emiratesca.com

Mobile:+971 50 282 8727

CA. Dhara Yagnik

Email: dhara@emiratesca.com

Mobile: +971 56 595 6836