Economic Substance Regulation[ESR]- Post Submission of Notification / Report

Economic Substance Regulation in the UAE was introduced in the year 2018 and came into effect for Financial Year starting from 1st January 2019. By now all the entities in the UAE are quite familiar with the term ESR [Economic Substance Regulation]. Every one of us is well aware that ESR Filing i.e., ESR Notification & ESR Report is required to be submitted by the entity conducting relevant activity in the UAE. Failure to furnish the details within the due date may attract penalties.

The requirements don’t end with the submission of the ESR Notification & ESR Report. Sometimes the Authority might require you to submit the additional information in support of your Notification &/or Report.

Below are some scenarios which you may come across post submission of ESR Notification/Report.

1. ESR Notification is filed twice since the first notification was not reflected on the dashboard

This situation was faced by many in the first year of filing with the Ministry of Finance (MoF) when the deadline was 31st December 2020 (later extended to 31st Jan 2021). The ESR notification was submitted but the same was not reflected on the dashboard. In such a case, it is highly recommended to save the submission key or take a screenshot of the same for any future correspondence. With reference to the submission key, an email can be sent to the Authority requesting to resolve the concern rather than filing the ESR Notification for the 2nd time.

2. ESR Report appearing more than once on the dashboard

This case may arise as a result of the submission of ESR Notification more than once. ESR notification can be submitted more than once for the following reasons:

- 1st Notification did not appear on the dashboard and hence 2nd or subsequent notifications were submitted (this seems to be scenario 1)

- There was an error in 1st Notification and hence to rectify the error you submitted 2nd and multiple Notifications. This is not the correct way to rectify your error in the 1st Notification. Error in the Notification could be rectified by requesting amendment in the previously filed Notification and not by submitting new/fresh notification.

ESR Report will appear on the dashboard number of times you have submitted the Notification. Therefore, do not submit multiple Notifications for the same entity. In case you have done so, kindly inform the concerned Authority to remove one notification (by providing the reference number) and the reason for the same. There are instances where the penalty was levied for a case where the 2nd ESR report was not submitted. In such a case, we can appeal and explain the reason to the authority along with proof of submission of the 1st/correct ESR report. To satisfaction of the Authority, the penalty may be annulled.

3. Request to furnish additional information in relation to ESR notification &/ or ESR Report

In some cases, the authority might require the entity to submit additional information in relation to details submitted in ESR Notification & ESR Report. This can be the submission of supporting evidence to prove the Core-Income Generating Activities (CIGA), or details of full-time qualified employees, or Board meeting/resolution, etc. Any additional information requested by the authority should be submitted well within the due date otherwise penalty can be levied.

4. Mistakes or errors in the details submitted in ESR Notification/ESR Report

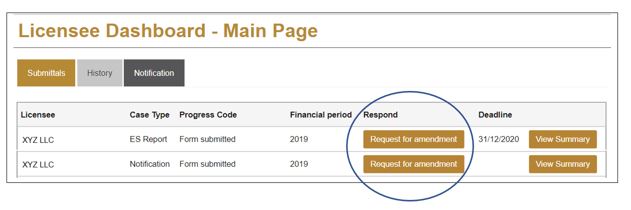

Post submission of ESR Notification/ ESR Report if come across that the details submitted has error or mistakes then do not submit the ESR Notification & Report. Rather Request for Amendment in the previously filed details. Now, where do you find the request for an amendment option? You may refer to the below screenshot for easy reference:

On your login to the ESR page, you may request for amendment on the dashboard. In case of any rectification do it via amending the previously filed Notification or Report.

The ESR experts at Emirates Chartered Accountants Group ensure compliance with the law at all levels.

For Queries and Consultation

CA. Dhara Yagnik, M.com, ACA

Manager – Audit & Taxation

M:+971565956836

E:dhara@emiratesca.com