Gratuity calculation in UAE

Gratuity calculation in UAE, as per UAE labour Law an employee who completed one or more years of continuous service shall be entitled to get the End of service benefits based on the type of contract ( limited or unlimited), the period of service, and the nature of the cessation of the contract ( Termination by the employer or resignation by the employee).

The days of absence from work without pay shall not be included in the calculation of the period of service. The Gratuity is calculated on the basic salary in the last drawn Wages. Other allowances such as housing, conveyance, overtime pay, education allowance, etc. will not be considered for calculating Gratuity. In any case, the entire Gratuity does not exceed 2 year’s total salary pay. (Refer Article 132 and 134 of UAE Labour Law) An employee shall be entitled to the gratuity for any fraction of a year he served, provided that he has completed one year of continuous service. (Refer Article 133 of UAE Labour Law) If the employee owes any money to the employer, the employer may deduct the amount from the employee's gratuity. (Refer Article 135 of UAE Labour Law) The Gratuity computation may vary depends upon the type of contract, the period of service, nature of cessation of the contract, etc. (Refer Article 137 & 138 of UAE Labour Law). An employee is not entitled to End of Service Benefits where he has been terminated due to misconduct as per the provisions of UAE Labour Law (Refer Article 120 of UAE Labour Law)

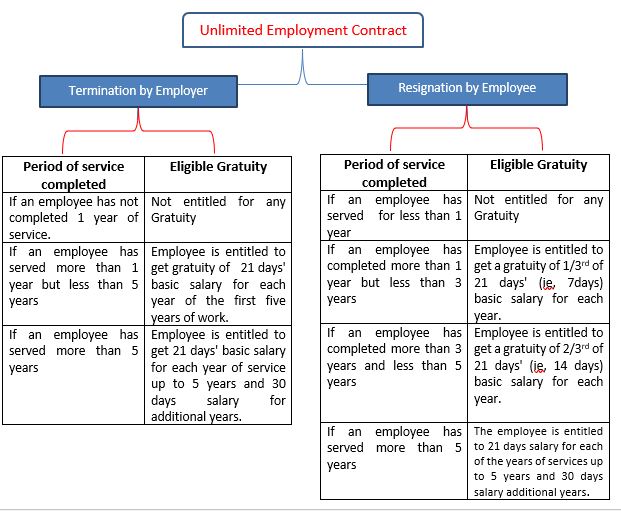

How to calculate gratuity in UAE for unlimited contracts?

Illustrative Example of Unlimited Contract when Termination is given by employer Scenario 1:

An employee earns a salary of AED 10,000/- (Basic Salary -5000, HRA 2000, and Transportation allowance AED 2,000). Calculation of Gratuity: 21days Basic Salary will be AED 5,000 X 21/30 = AED 3,500/-

| Period of service completed | Eligible Gratuity |

| If the employee has not completed 1 year of service. | Gratuity – Zero |

| If the employee has served for 4 years | Gratuity will be AED 3,500*4=14,000/- (21 days basic salary for each year ) |

| If an employee has served for 7 years |

Gratuity will be AED 27,500/- [21 days salary for the first 5 years (AED 3,500 x 5 years) plus 30 days salary for a period exceeding 5 years ( AED 5,000 x 2 years ) ] |

Example of an unlimited contract when Resignation is given by Employee

Calculation of Gratuity (Based on the illustration in Scenario 1)

| Period of service completed | Eligible Gratuity |

| If the employee has not completed 1 year of service. | Gratuity – Zero |

| If the employee completed 2 years of service | Gratuity will be (AED 3500*2*1/3) =2,333/-(1/3rd of 21 days' basic salary per year) |

| If the employee has served for 4 years | Gratuity will be (AED 3,500*4*2/3) =9,333/- (2/3rd of 21 days basic salary for each year ) |

| If an employee has served for 7 years | Gratuity will be AED 27,500/- [21 days salary for the first 5 years (AED 3,500 x 5 years) plus 30 days salary for a period exceeding 5 years ( AED 5,000 x 2 years ) ] |

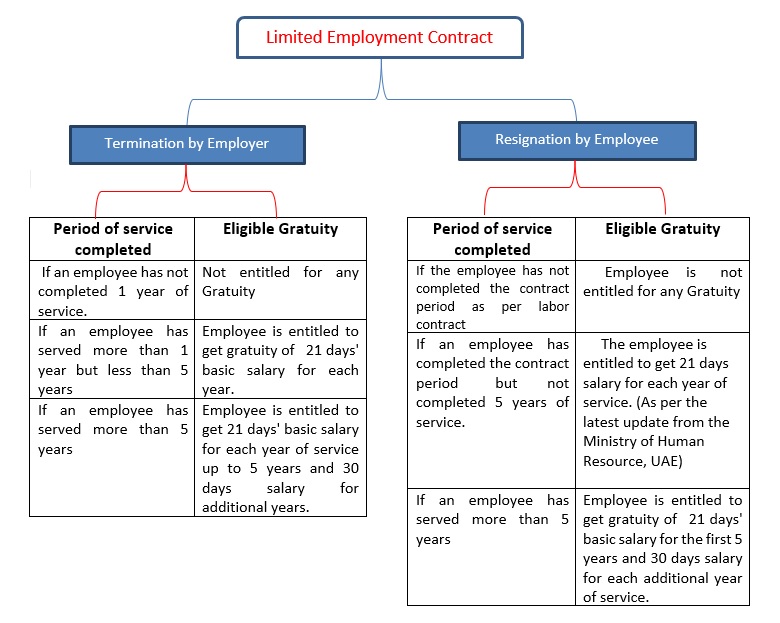

How Gratuity Calculated under Limited Employment Contract is as below:

These calculations are not to be treated as law, they are for your reference only. For any disputes or further clarification, contact the UAE Ministry of Human Resources and Emiratization.

Note: The new UAE labour law took effect on 2nd February 2022. In accordance with the new UAE Labour Law, only limited-term labour contracts are permitted. All existing unlimited contracts must be converted to limited-term contracts within a year of their effective date, i.e., 2nd February 2022, and gratuity will also be calculated in accordance with limited-term contracts.

Gratuity Calculator - Dubai Development Authority (DDA)

The electronic sample gratuity calculator has been prepared by Dubai Development Authority ( DDA) for their Licensees and their employees in respect of their employment matters. The information and details contained herein are based on the minimum terms and conditions prescribed in the UAE Labour Law, and any outcome resulting from the use of the Gratuity Calculator should not be construed as final and binding. They are meant to serve merely as guidance and consequently have no legal merit. Neither DDA nor ECA is responsible for any errors or omissions, or the results obtained from the use of this information, and ECA or DDA make no representations, warranties, or guarantees, whether express or implied that the information and content are accurate, complete, and up-to-date. They can also be subject to amendments from time to time.

Emirates Chartered Accountants Group is a one-stop solution for all your business needs, providing services all under one roof. What do we offer? Audit & Assurance, Accounting & Financial Advisory, VAT Services, Business Advisory, Company Incorporation, and Management Consultancy.

We are ISO certified Chartered Accountants firm and our Audit Division (United Auditing) and consultancy divisions are listed in all major banks, approved auditors in all the free zones, and listed with different government departments as well. We are also a registered Tax Agent under the Federal Tax Authority (FTA) in the name ECA Taxation Procedures Follow-up LLC under the Emirates Chartered Accountants Group in order to provide exclusive Tax Agency Service to our clientele. Being in the service industry for more than a decade, we house the best professionals to provide quality service with precision at work to our clients. The firm has branches in all other emirates of UAE, Bahrain, India & UK.

Our Core Services: