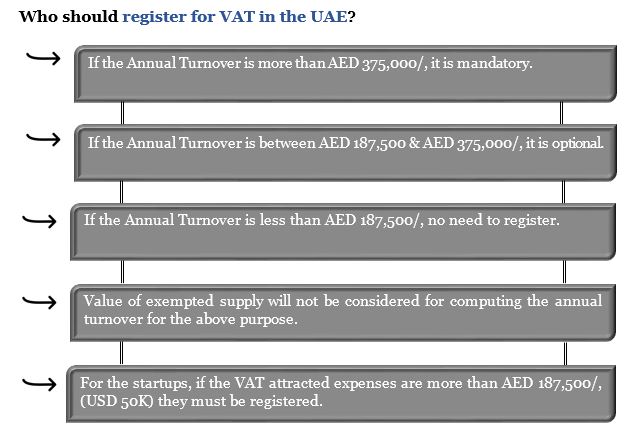

Register for VAT in the UAE

VAT in the UAE is taking its course of action from 1st January 2018 at a minimal rate of 5%. It is compulsory for businesses to register for VAT in the fourth quarter of the year 2017. VAT Registration in UAE will be an online process using eservices.

When a company has to do the VAT registration in the UAE?

As per the information provided by the Ministry of Finance website the online portal for VAT registration will be opened in the 3rd quarter of the year 2017. It is optional to register in the 3rd quarter and mandatory for all companies who are coming under the turnover threshold to get registered before the end of the 4th quarter.

How to submit VAT returns in the UAE?

Companies registered for VAT need to submit their VAT returns on a quarterly basis. Such VAT returns are to be submitted within one month from the end of each quarter. VAT filing for registered companies will also be an online process using eservices. Businesses also need to maintain all the transaction records which will allow the Federal Tax Authority to recognise the business activity for evaluation. Emirates Chartered Accountants Group provides expert professional service for VAT Registration, VAT implementation,

VAT filing/VAT returns Services –

A one-stop solution for your business.

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 4414

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115