How VAT is Applicable to Online Marketing Services in the UAE?

The industry of digital marketing services is widespread across the UAE where it is rendered across different platforms such as E-Mail Marketing, Social Media Marketing, Search Engine Marketing, SEO etc. With the introduction of VAT in UAE since 1st January 2018, these services are taxable at 5%. In the given scenario, marketing companies located within UAE having a VAT Registration number should pay special attention for VAT implementation in the UAE to the types and mode of a transaction conducted by them with regards to the provision of UAE VAT law in online services.

Complications usually arise in different forms such as the location of the supplier and recipient of service, the performance of service, invoicing for a composite supply of goods and services (eg: marketing material supplied along with content hosting services) and billing through a third-party entity.

In this article, we shall explore the various scenarios for VAT in UAE to determine the tax impact that an online advertiser needs to look out for while engaging with prospective customers. At the end of this article, relevant provisions of UAE VAT law that are applicable have been quoted for easy reference.

Since UAE VAT has been introduced, while analyzing the VAT impact, it is important to understand the exposure of the business to different business and location of different clients. If the marketing agency is engaged in online and offline advertising, the UAE VAT impact needs to be understood for offline advertising based on the location of ads posted. However, in the case of online advertising, an analysis will be required to map the compliance requirements.

Below, we shall discuss a few steps to comply with UAE VAT law:

- Prepare a list of all online marketing and advertising services provided that are subjected to VAT in UAE.

- Identify the location of customers and target audience for each of these services. If it varies, transaction wise, the same shall be identified for each transaction individually.

After obtaining the information as per the above steps, the next step would be to identify tax liability and responsibility at the time of entering into the contract itself. A few scenarios have been mentioned below to understand the impact

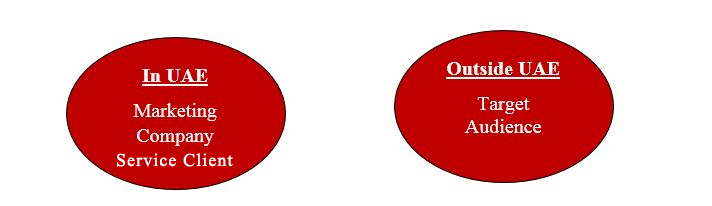

SCENARIO 1

In the above scenario, the Place of supply of service shall be considered as outside UAE and thus outside the scope of UAE VAT. The consumption of service is happening outside UAE and thus based on actual use and enjoyment, the same shall not be taxable.

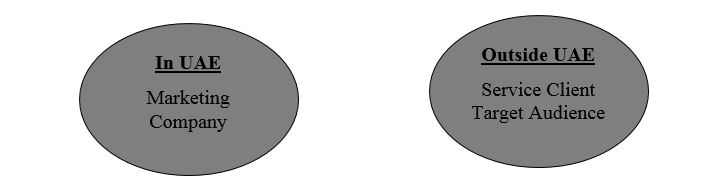

SCENARIO 2

In this scenario, the target audience as well as Service client are located outside UAE. Hence the same falls outside the scope of UAE VAT and thus the same shall not be taxable.

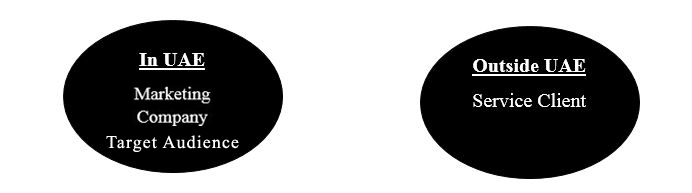

SCENARIO 3

In the given scenario, since the client does not have a Fixed establishment in the State, the transaction shall be treated as an export of service subject to 0% tax and thus treated as a zero-rated taxable supply, since it is consumed and enjoyed within the state. The Place of supply shall be considered in UAE and thus taxable.

SCENARIO 4

Since the supplier, customer and end consumers are located in UAE itself, UAE VAT law is applicable at a standard rated supply and tax shall be charged at the rate of 5% on the value of supply.

Note:

Outside UAE, as per the above scenarios, refers to countries apart from the VAT Implementing States as per the GCC VAT Agreement. At present in 2018, only KSA is implementing VAT along with UAE and thus the transactions should be reviewed separately to understand the VAT impact.

Summary of the above scenarios:

| Scenario | Place of Supply | Tax Impact |

| 1 | Outside UAE | NIL |

| 2 | Outside UAE | NIL |

| 3 | Inside UAE | Zero Rated (0%) |

| 4 | Inside UAE | Standard Rated (5%) |

Once the tax impact has been identified for the transaction, the same needs to be considered at the time of raising invoice. RELEVANT PROVISIONS OF LAW: The following services have been identified as ‘Electronic services’ as per Article 23 of the Executive Regulations of UAE VAT Law:

- Supply of domain names, web-hosting and remote maintenance programs and equipment;

- The supply and updating of software;

- The supply of images, text, and information provided electronically such as photos, screensavers, electronic books and other digitized documents and files;

- The supply of music, films and games on demand;

- The supply of online magazines;

- The supply of advertising space on a website and any rights associated with such advertising;

- The supply of political, cultural, artistic, sporting, scientific, educational or entertainment broadcasts, including broadcasts of events;

- Live streaming via the internet;

- The supply of distance learning;

- Services of an equivalent type which have a similar purpose and function

As per Article (31) of the Decree Law ‘Place of Supply of the Telecommunication and the Electronic Services’ For the telecommunications and the electronic Services specified in the Executive Regulation of the Decree-Law, the place of supply shall be:

- In the State, to the extent of the use and enjoyment of the supply in the State.

- Outside the State, to the extent of the use and enjoyment of the supply outside the State.

The actual use and enjoyment of all telecommunications and electronic Services shall be where these Services were used regardless of the place of contract or payment.

As per Article (31) of the Executive Regulations of UAE VAT Law ‘Zero Rating the Export of Services’:

1. The Export of Services shall be zero-rated in the following cases. a. If the following conditions are met:

- The Services are supplied to a Recipient of Services who does not have a Place of Residence in an Implementing State and who is outside the State at the time the Services are performed;

- The Services are not supplied directly in connection with real estate situated in the State or any improvement to the real estate or directly in connection with moveable personal assets situated in the State at the time the Services are performed.

b. If the services are actually performed outside the Implementing States or are the arranging of services that are actually performed outside the Implementing States. c.If the supply consists of the facilitation of outbound tour packages, for that part of the service.

2. For the purpose of paragraph (a) of Clause (1) of this Article, a person shall be considered as being “outside the State” if they only have a short-term presence in the State of less than a month, or the only presence they have in the State is not effectively connected with the supply.

Emirates Chartered Accountants Group offers businesses in the UAE with an extensive range of TAX Services with accordance to their business to comply with the UAE VAT in the Dubai, Abu Dhabi, Sharjah, Ajman, Fujairah, & Ras Al Khaimah. The Tax Team at Emirates Chartered Accountants Group are professionally equipped with appropriate experience in taxation from different parts of the world

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115