- Jul 19,2022

- All | International Taxation

What is Transfer Pricing?

Conceptually, Transfer Pricing refers to a pricing mechanism with respect to the price charged for goods and services supplied or transferred by one subunit of an organization to another sub-unit or one group member to another (intra-group transactions). Further, intra-group transactions can be restricted within a country or the same can be cross-border.

From a taxation perspective, be it local or cross-border, organizations are expected to transact on an arm’s length basis i.e. as if the same is being transacted between two unrelated organizations. In other words, intra-group transactions ought to be undertaken uninfluenced by the relationship of the transaction organizations.

Why Transfer Pricing?

Transfer Pricing in the context of cross-border transactions assumes greater importance. This is so as markets are no longer local. The positive impact of Globalisation has led to the free movement of capital, labor, goods, and services. There are no national barriers to international trade.

Multi-National Enterprises (MNEs) are operating across the globe such that they are able to tap the comparative advantages available in other jurisdictions. Therefore, the importance and significance of Transfer Pricing for both, business and revenue authorities.

From a business perspective, it is imperative that profits are linked to the economic activity undertaken by the respective entity within the MNE group; the same is equally essential from Revenue Authorities’ perspective as each country would want its fair share of tax. Therefore, almost all the countries engaged in active international trade have Transfer Pricing Regulations (both Direct and Indirect Tax) to ensure that there is no shift of profits, which creates any tax arbitrage opportunity i.e. there is no artificial shift of profits from high tax to low tax jurisdiction.

Importance of Transfer Pricing Compliance

Non-compliance with arm’s length standard can lead to penalties in addition to additional tax, including at times double taxation in absence of the corresponding adjustment in the other country. The importance of the arm’s length standard is also laid down under Article 9 of the Organisation for Economic Co-operation and Development’s (OECD) Model Tax Convention.

While the CbCR requirements are already applicable to the UAE-headquartered MNE Groups with 'financial reporting years' starting on or after 01 January 2019, the proposed Corporate Tax Regulations in the UAE also indicate that the businesses in the UAE would be required to maintain documents relating to Transfer Pricing (Master File and Local File) in the format consistent with OECD requirements and submit a disclosure containing information regarding related / connected party transactions.

Follow the Guidelines issued by OECD

To simplify and address this complex issue of Transfer Pricing, OECD and the United Nations (UN) have been working and issuing guidance, which assists both business and Revenue authorities and developing strategies and protecting the corporate tax base respectively.

With the release of the updated Transfer Pricing Guidelines, the OECD release also includes transaction (complex) specific guidance viz; Guidance notes on Intangibles, financial Transactions, Business Restructuring, etc. to name a few.

It is imperative here to note that The Public Consultation Document issued by the UAE Authorities indicates to follow guidelines on Transfer Pricing issued by the OECD.

Documentation

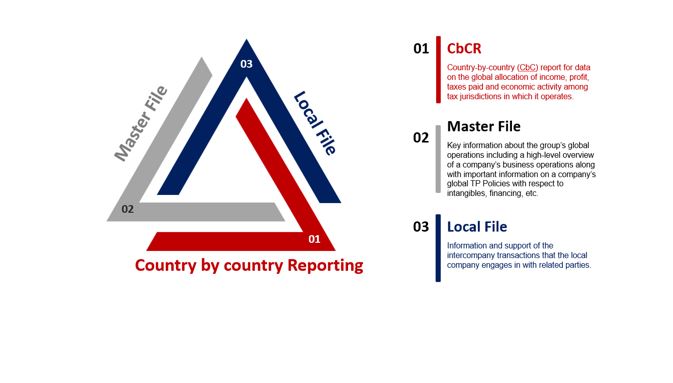

“Documentation” is the backbone of any Transfer Pricing policy. Both OECD and UN, prescribe three-tier documentation

In fact, Action Point 13 of the BEPS plan attempts to streamline the documentation requirements. Most countries have incorporated the above in their domestic law. Whilst the subject compliance is mandatory, it is Documentation that helps businesses to develop sound transfer pricing strategies and is the backbone of any transfer pricing audit.

For businesses in countries where Transfer Pricing Regulations are proposed viz. UAE, it is essential that businesses understand the nuances of the proposed regulations in terms of the applicability, including covered transactions and entities, undertake supply chain analysis, formulate formal policy in alignment with global policy, if any, etc.

Transfer Pricing Review Risk

The Tax Authorities follow a risk-based approach in selecting cases for review. With the review of Tax Returns, the review of Transfer Pricing policy will be under the watchful eye too.

Certain business profiles or characteristics— low margins, persistent losses, profit volatility, management fees, huge intangibles in the books or payment therefor, significant transactions with zero- or low-tax jurisdictions, substantial revenues from connected parties, insufficient documentation, and recurring business restructuring—are red flags and so are more likely to be investigated.

To manage risks related to Transfer Pricing, we suggest that businesses holistically review and assess risks to the entire group. Further, it is important that businesses inter-alia have the following details/documents in place:-

- agreements to support dealings with connected parties

- conduct economic analysis and benchmarking studies for the covered transactions,

- prepare cash flow and income projection to justify loss-making activities

- prepare and maintain local and master files.

How Can We Help?

The Specialized Transfer Pricing team of Emirates Chartered Accountants Group can help you analyze the impact of Transfer Pricing Regulations on your business.

We are also coming up with a series of webinars to help you navigate through the forthcoming Transfer Pricing Regulations.

Please feel free to reach out for transfer pricing in UAE.

Purvi Mehta

Manager – Direct Tax

M: +971 52 2500480

E: purvi@emiratesca.com