- Oct 02,2019

- Bahrain VAT

VAT Registration in Bahrain

Bahrain has committed to introducing Value Added Tax (VAT) by 1st January 2019. VAT in Bahrain is also welcome for business development in Bahrain. The GCC countries agreed to implement VAT at a standard rate of 5%. Accordingly, 5% VAT will be launched in Bahrain as of January 1st, 2019 with a few exceptions. Value Added Tax (VAT) is an indirect tax charged on selected goods and services bought and sold by businesses.

VAT Registration in Bahrain VAT registration in Bahrain is the process through which a taxable entity in Bahrain is required to be registered for VAT. Upon registration, a dedicated VAT account number will be assigned to the entity. An entity has to apply for Bahrain VAT registration once the Turnover is as given below and has exceeded the threshold as specified.

Following sales are to be considered for arriving the threshold.

- Standard rated supplies

- Zero-rated supplies

- Reverse charged services received &

- Imported Goods.

However, exempted supplies should not be considered.

What is the Mandatory Registration?

- Any taxable persons in Bahrain with turnover exceeding or expected to exceed BHD 5 Million annually are legally required to register for VAT by December 20th, 2018.

- Any taxable persons with turnover exceeding or expected to exceed BHD 500,000 and BHD 5,000,000 annually are required to register for VAT by June 20th, 2019.

- Any taxable persons with turnover exceeding or expected to exceed BHD 37,500 and BHD 500,000 annually are required to register for VAT by December 20th, 2019.

What is the Voluntary Registration?

Any taxable persons over BHD 18,750 in annual supplies are eligible for voluntary registration.

How can Non-Residents in Bahrain register for VAT?

Non-Residents (with no fixed place of business or fixed establishment) are required to register for VAT in Bahrain within 30 days from the first taxable supply to non-taxable persons in Bahrain, regardless of the thresholds mentioned above. Non-Resident taxable persons can apply for VAT in Bahrain registration with the National Bureau for Taxation (NBT) directly or by appointing a Tax Representative to act on their behalf. The NBT has the right to request and obtain the necessary documentation from the taxable entity to prove that the registration requirements are met.

How to create a profile in NBT for Bahrain VAT?

To create a profile in NBT for VAT in Bahrain you first need to fill the form in the NBT site. The process can be completed online and need to ensure that it is done before the date prescribed.

How to register for VAT in Bahrain?

To apply for VAT in Bahrain Registration you can access the NBT site online portal and start the registration process. The process of registration is as laid down below:

What are the Steps for VAT Registration in Bahrain?

Step 1: To register for VAT, the taxable entity must first create an NBT profile. Click “Create NBT Profile”.

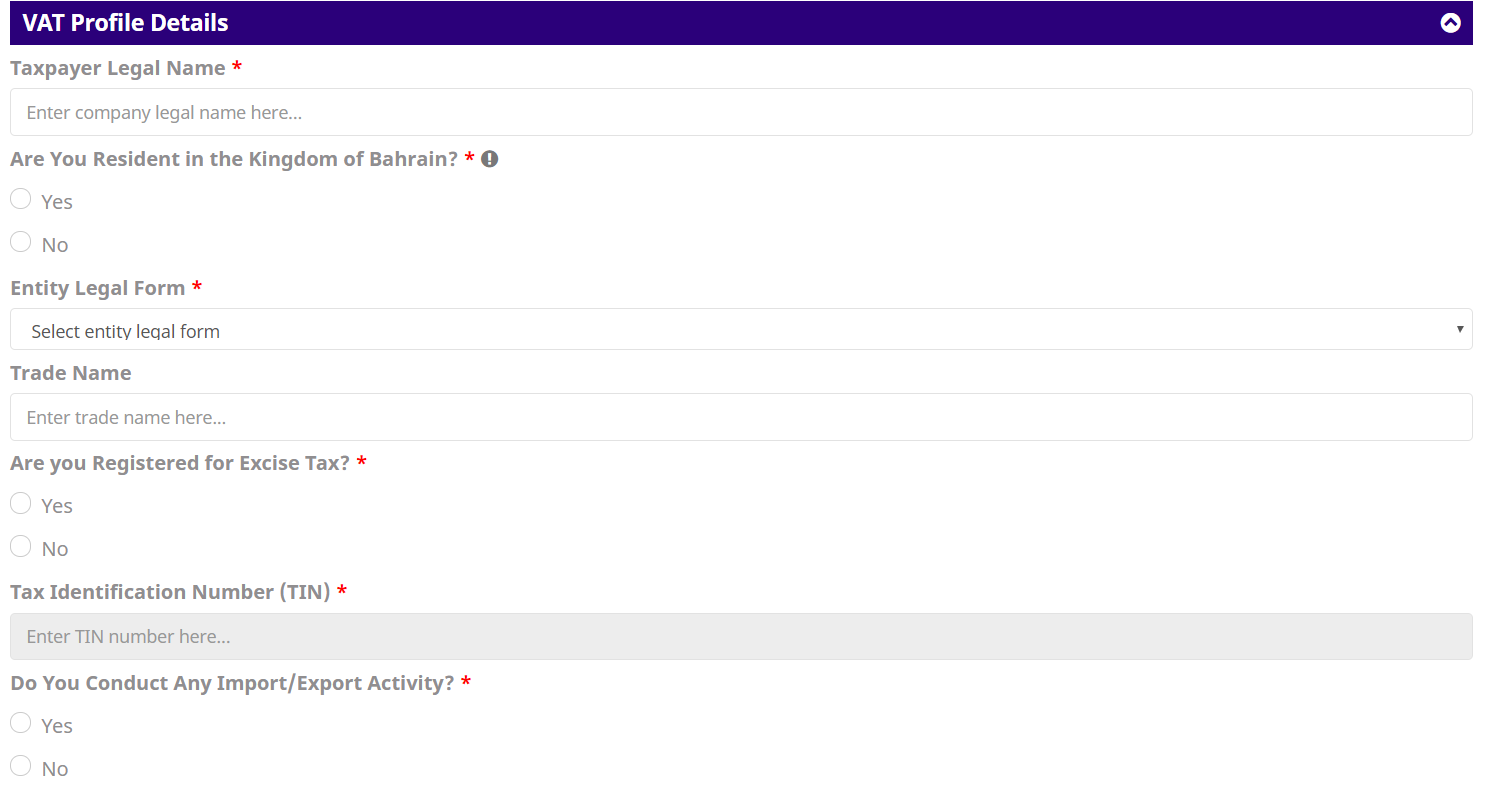

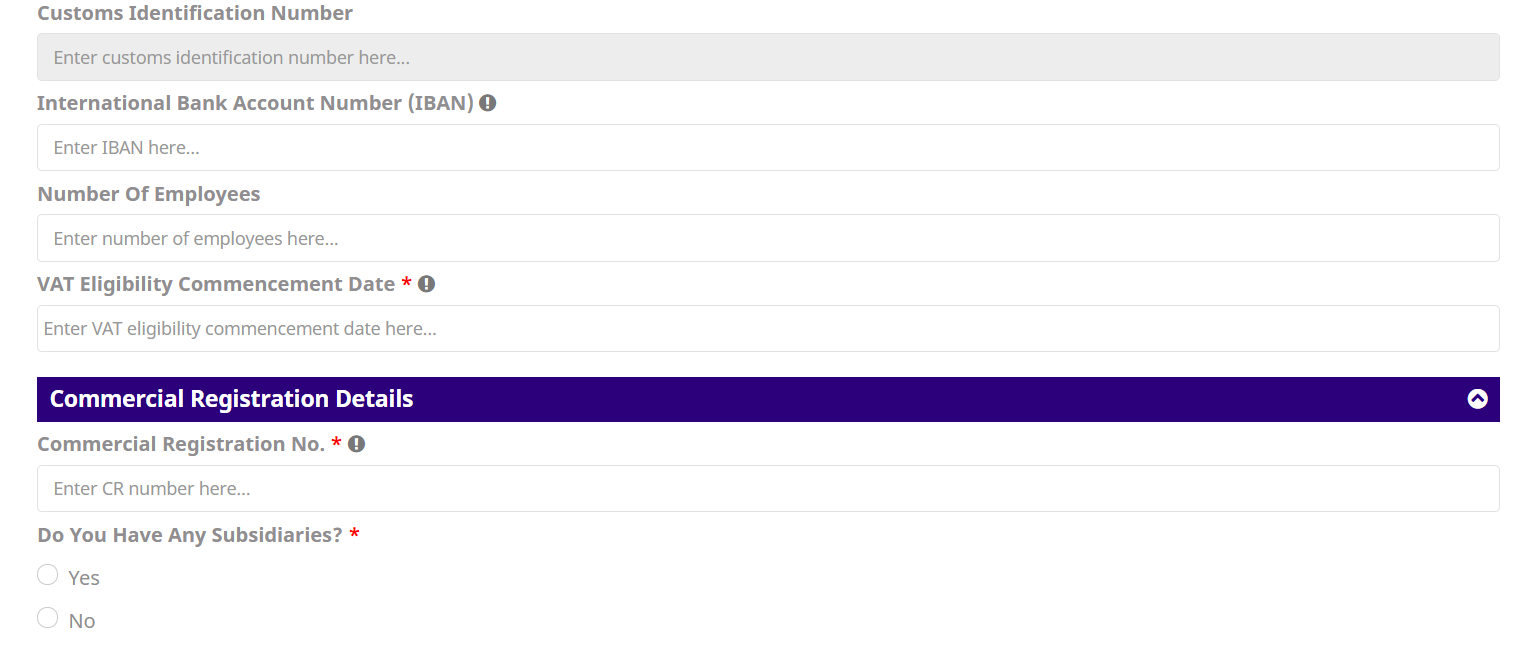

Step 2: The taxable entity is required to populate the NBT form and specify their information including:

- Taxpayer details (Legal name, Legal form, Address, contact details, VAT eligibility date etc.)

- Commercial registration details (CR Number, CR date, Subsidiary details, Sector etc.)

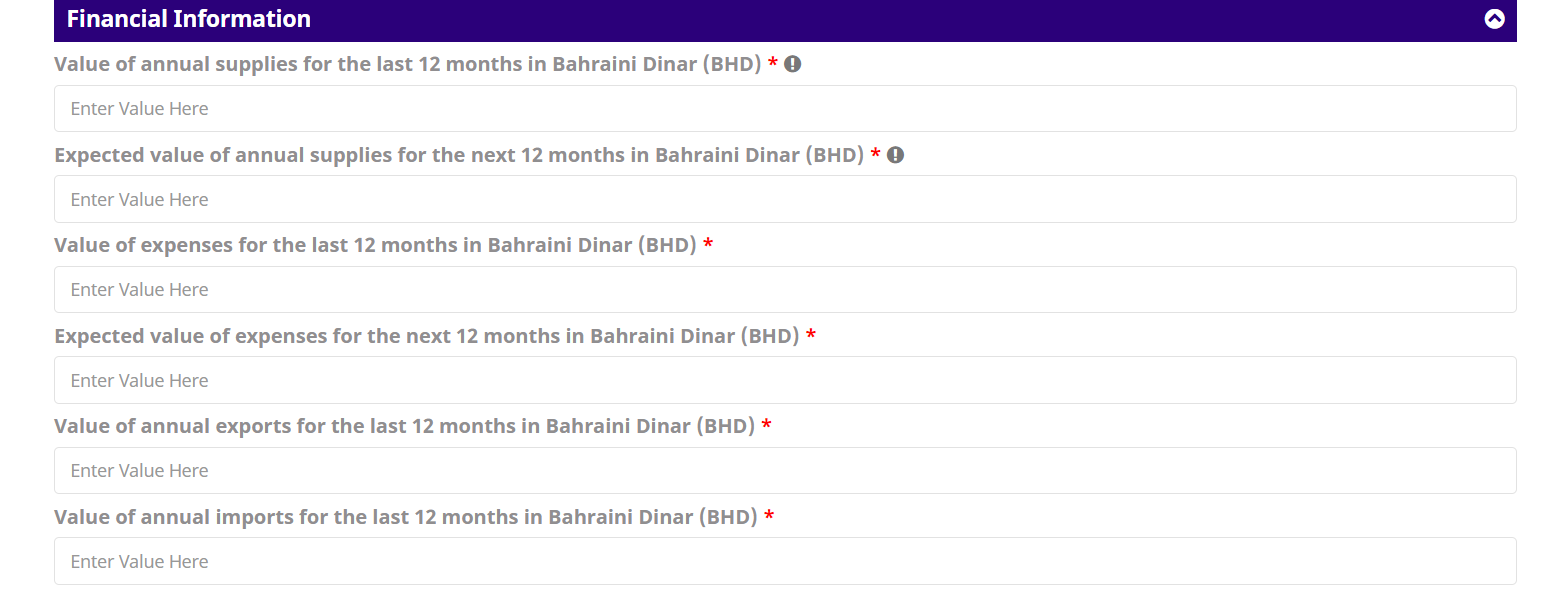

- Financial information (annual value of supplies, expenses, imports and exports)

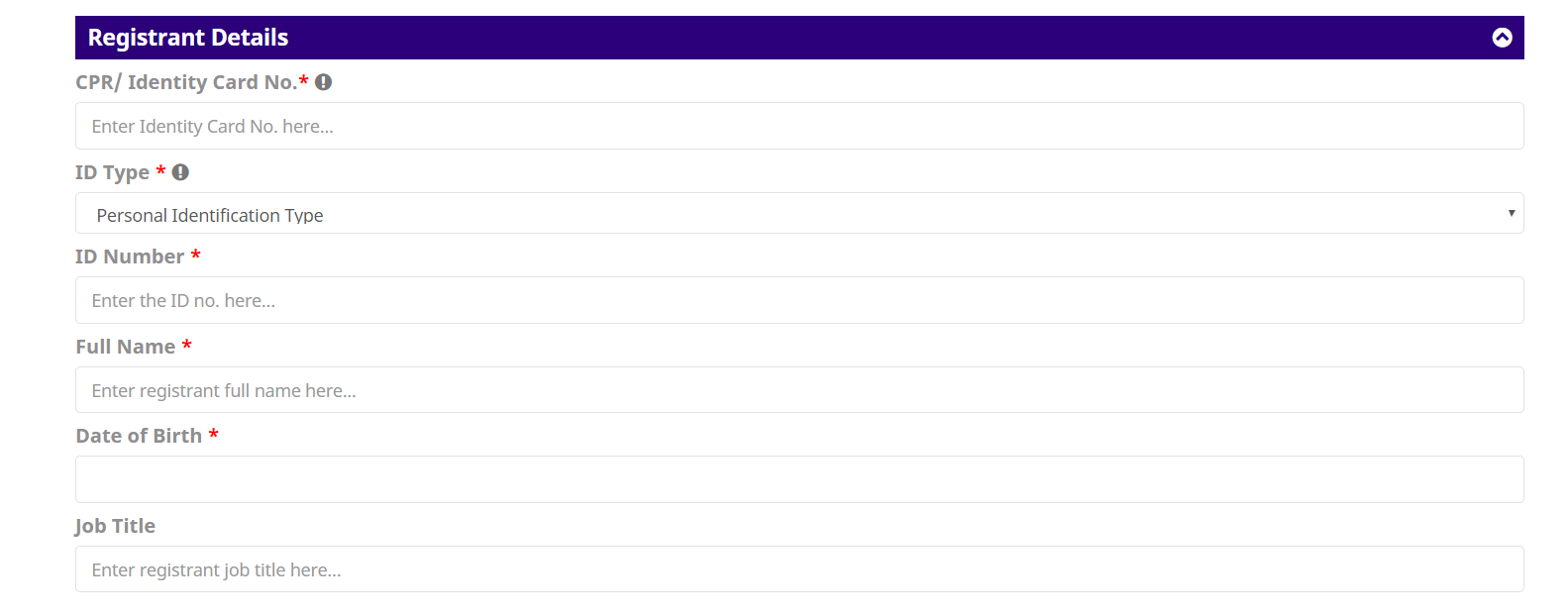

- Registrant details (Name, identification number, DOB, job title etc.)

- Documentation (commercial registration certificate, customs registration certificate, audited financial statements, copy of registrant ID, etc.)

Step 3: The taxpayer submits the profile creation request. This NBT profile can be created online.

Step 4: If taxpayer’s NBT profile is approved, they will be provided with login details to access the registration form.

Step 5: The registration form can be completed in a “single click”. Once the submission is reviewed and approved by NBT, The VAT certificate will be available on the taxpayer’s NBT profile.

What are the other information required while registering for VAT in Bahrain?

- Business activity of the company

- Previous 12 months turnover figures

- Projected Sales

- Previous 12 months expenses figures

- Projected expenses

- Expected values of imports and exports

- Customs Identification Number

- Bank account details etc.

What are the important points to be considered while giving the bank account details?

If you are registering your company as a standalone, you can give any one of the Bahrain bank accounts. You have to provide the IBAN code. You should give the bank account of the company for which you are registering, and not of any other related party bank account.

What are the documents required for VAT registration Bahrain?

The documents required for registering the VAT is as follows:

- Copy of Commercial Registration Certificate*

- Independent Auditors Report

- Audited Financial Statement

- Expense Budget Report

- Proof of relationship between HQ and Subsidiary

- Customs Registration Certificate

- Copy of Association/Partnership agreement

- Copy of Certificate of Incorporation

- Copy of Personal Identification of The Designated Person*

It should be ensured that all the figures submitted to NBT shall be accompanied with the proper supporting. * Mandatory documents

How can Emirates Chartered Accountants Group support you?

We Emirates Chartered Accountants Group operates an exclusive TAX division to handle all types of indirect tax services in Bahrain; we support the clients by guiding them for Online VAT registration. Our team shall provide VAT registration services for Bahrain VAT. In order to avail our services, you may please contact representatives mentioned towards the end of this blog. Our team will collect all required documents and information for registering your company for VAT in Bahrain.

You may provide those details by email. We need the documents only in soft copy, since the registration has to be done through online portal. Once we receive all documents and the necessary information for VAT in Bahrain registration and upon your approval, we will proceed to register in the online portal of NBR for VAT in Bahrain with your email ID. Once we complete filling the form the draft will be forwarded to you to have a review and for final approval.

Only after getting your approval, we will be submitting the form to the NBR. The NBR will then process the application and will respond to confirm your Tax Identification Number. Further, the VAT Division is also into VAT Implementation services, VAT advisory services, VAT return filing services etc.

Please feel free to contact our below representatives for VAT registration in Bahrain We provide the below-mentioned Tax Services in Bahrain:

- VAT Implementation

- VAT Registration

- VAT Compliance

- VAT Return Filing

- VAT Advisory

- Excise Tax Registration

- Excise Tax Advisory

VAT Services in BahrainContact Person: Mr. Bichin Email: br@emiratesca.com Mobile: +973 3619 8998 Website: www.ecabahrain.com |