15 Easy Steps You Can Turn UAE VAT Return Filing into Success

The first value-added tax (VAT) return has given a cool off time for filing by the Federal Tax Authority (FTA) for easing reporting and compliance pressure on companies, especially SMEs. All companies must log onto the FTA's website and check the tax period under their profile. Some of the companies have been given one month as the first VAT Return Period whereas for most of the companies the first VAT Return (varies from three to five months).

15 Steps for VAT Return filing

Step 1:

Login to the portal of the Federal Tax Authority at www.tax.gov.ae with your registered user name and password.

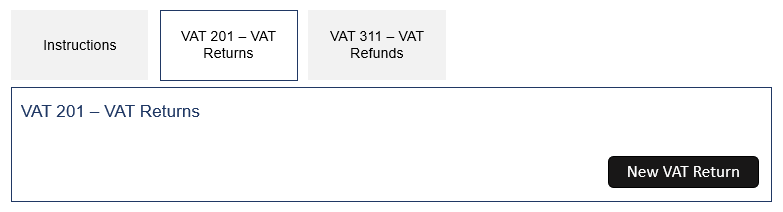

Step2:

Click on VAT 201 – New VAT Return option under the e-services section of the portal to initiate the VAT Return form.

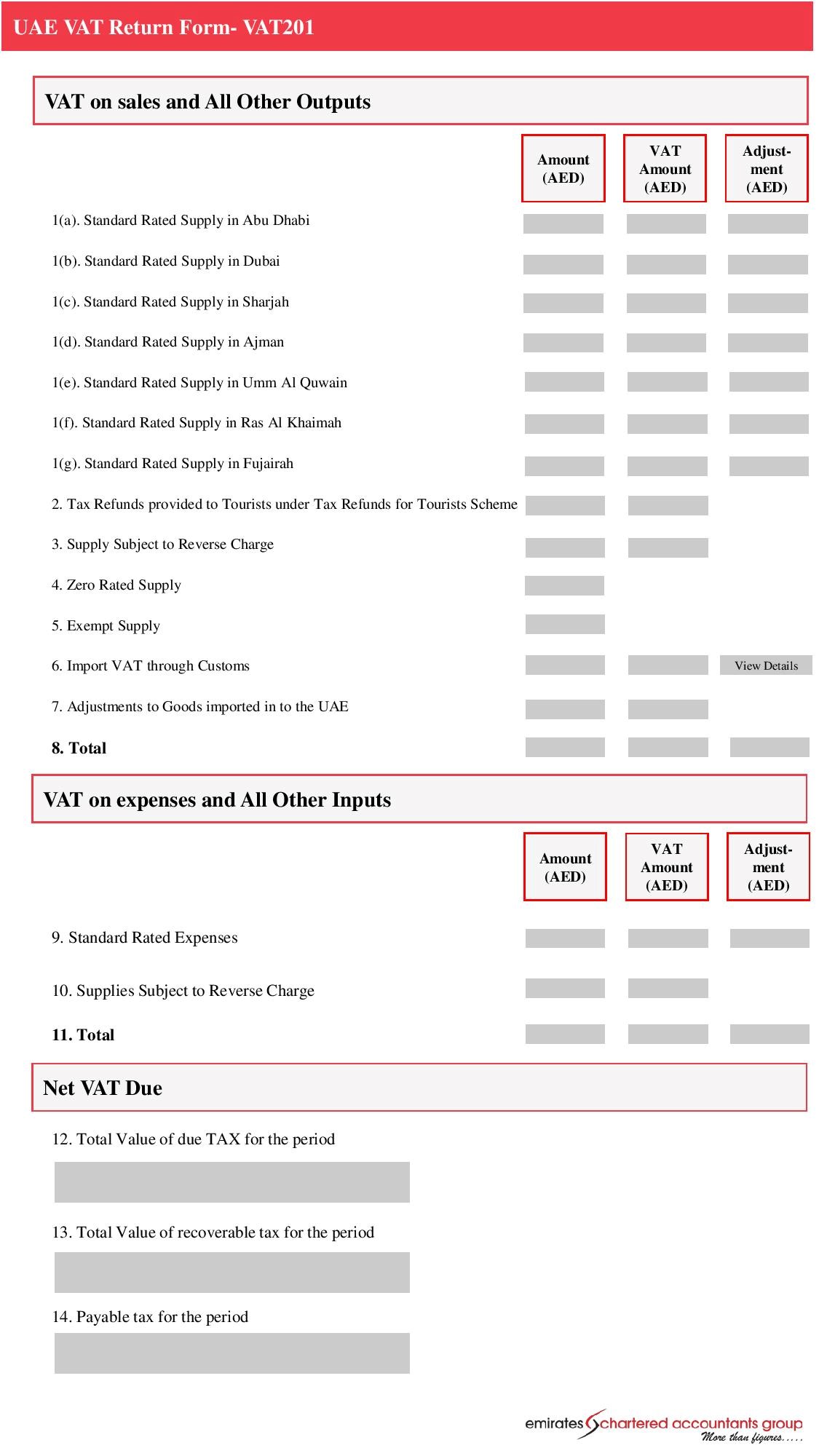

Once you click VAT 201 – VAT Return form you can see the VAT Return form which has the following contents.

The above form is the VAT Return form available in your account once you navigate to VAT 201 Form.

Step 3. Fill the contents of standard-rated supplies from box 1a to 1g.

All Standard Rated Supplies should be reported Emirate wise for VAT Return Filing. For example: if a company has Head Office in Dubai and a branch in Sharjah, all the sales made from Dubai HO will be reported as Dubai Sales (1b) and all sales from Sharjah Branch will be reported as Sharjah Sales (1c). Even though the delivery of material is happening in different Emirates, the above reporting doesn’t change. For non-established businesses in the UAE, supplies have to be reported in the Emirate where the supply is received. For example, if the company sells AED 1,000,000/- from Dubai Office and AED 500,000/- from Sharjah Office the respective amount without VAT will be showing as sales under amount column. AED 50,000/- will be showing as VAT against the Dubai Sales and AED 25,000/- will be showing as VAT against Sharjah sales.

Step 4: Treatment of Tax Refunds provided to Tourists

This is the tax refund treatment to tourist under the tax refunds for tourist scheme. As of now 22.02.2018 the scheme is not released by the authority and hence you can skip this step.

Step 5: Supplies subject to the reverse charge provisions.

Goods imported through UAE customs will be reported under Step No. 8 below. In this step, we will include the services which we imported during the period. For example, if the company has received a service from a lawyer firm located outside UAE worth AED 100,000/-, 5% VAT i.e. AED 5,000/- will be shown as Output VAT under this step. However, the same amount can be taken as input under Step No. 11 below (provided other provisions of the law is met).

Step 6: Zero-rated supplies

In this step we have to include all the supplies made under zero-rated vat (“zero-rated supplies”). Since the VAT on supply is calculated at Nil, only the net value of the supply should be stated here. For example, if the company exports goods to outside UAE worth AED 1,000,000/- the sales value will be shown under this box.

Step 7: Exempt supplies

This step includes only the exempted supplies made during the period. As there is no VAT on such kind of supplies, only the net value of the supply is to be stated in this Box.

Step 8: Goods imported into the UAE

Goods that have been imported through UAE customs are to be disclosed under this step. The sum of customs declared value (CIF) and the customs duty amount will be the amount to be shown as the value of an import. This amount will include the excise duty as well if the product is taxable under Excise law. 5% tax on above has to be shown as tax payable. This amount will be automatically populated in your VAT Return form. For agents who import goods into the UAE on behalf of the non-registered persons, it is their responsibility to pay tax for the import of goods. The input credit can be taken against the amount disclosed under this step. Such input credit has to be disclosed under Step No. 11 below.

Step 9: Adjustments to goods imported into the UAE

In case there are any corrections or omissions on the figure disclosed under Step No. 8 rectification can be done by using Step No. 9. The figures could vary from positive to negative figures but when questioned by the FTA should be answerable. For agents who import goods into the UAE on behalf of non-registered persons, it is the agents’ responsibility to pay tax for the import of goods. In case there are any corrections to be made or you might have missed inserting the figures you should use this Step No. 9 to amend the figures accordingly.

Step 10: Standard rated expenses

This step is for all the expenses pertaining to the standard rate of VAT to recover the Input Tax. This includes the purchase of goods from the local market as well. The total amount of the purchase and expenses made for which you want to avail the Input Tax, the figure should be stated in the “Amount (AED)” column. This should not include the tax element we paid to the suppliers or service providers, only net of tax. This column should only include the VAT you will be able to recover and not the total value of VAT that you have incurred on all costs.

Step 11: Supplies subject to the reverse charge provisions

Any output tax payable under the reverse charge mechanism that has been stated in Step No. 5, 8 & 9 above, can be recovered under this step. On expenses where VAT is incurred and falling under the Reverse Charge Mechanism for which Input Tax is not recoverable, those expenses should not be stated in this step. If you have paid VAT during import due to any reason, such VAT amount also can be recovered under this Step.

Step 12: Calculation of due tax or recoverable tax for the period

The difference between output vat and input vat is the amount payable the authority during the period. In cases where the Output figure is more that the Input figure, there is a provision to request for a refund for the net amount of recoverable tax. In Case you do not want your refund of the excess sum, you can carry that forward to subsequent Tax Period which can be adjusted for Tax payable or penalties or you can apply for a refund anytime.

Step 13: Step for a refund of excess recoverable tax.

The Option for net recoverable tax will be available on VAT return for recovery of excess tax. There will be two options ‘YES’ & ‘NO’. If you select ‘YES’, kindly fill and complete the VAT Refund Form VAT 311 once VAT Return Form is submitted. If you select ‘No’ your excess tax amount to be recovered will be taken forward for Subsequent Tax Period which can be used to pay for subsequent tax period or penalties.

Step 14: Submit the VAT Return form and you will receive a confirmation email for submission.

During the preparation of VAT Return form at any step mentioned above you can save as a draft in between and continue at a later stage. Before submitting the VAT Return form, you prepared, you have to review all the information entered to ensure it is correct. Once you complete your review you can click submit button. Once you submit the VAT Return form, you will receive an email upon submission for confirmation.

Step 15: How will you pay VAT?

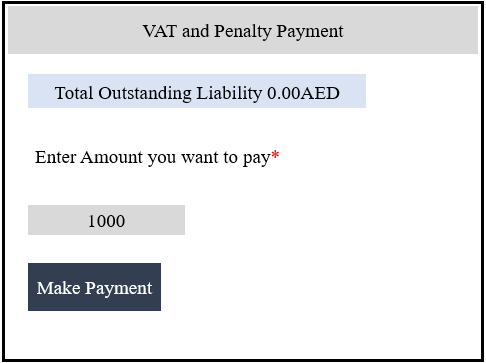

Steps for paying VAT liability and administrative penalties are below:

1.Go to “My Payments”

2.Enter the figure that you should pay and click “Make Payment”.

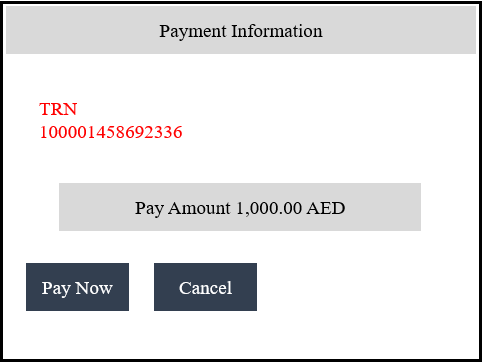

3.You will then be directed to the ‘Payment Information’ screen to proceed with the payment. Click on the ‘Pay Now’ button to be directed to the e-Dirham gateway.

4. You may pay using the e-Dirham payment gateway which supports payments through an e-Dirham card or a credit card (Visa and MasterCard only). A payment using an e-Dirham card will typically incur a charge of AED 3, while a payment using a credit card will typically incur a charge between 2% - 3% of the total payment amount

What you should keep in mind when completing the VAT Return?

When completing each step of the VAT Return, you must:

- Insert all amounts in United Arab Emirates Dirhams (AED)

- Insert all amounts to the nearest fils (the form allows for two decimal places)

- Complete all mandatory fields

- Use “0” where necessary and where there are no amounts to be declared.

Emirates Chartered Accountants Group provides optimum VAT Return Filing Services in Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman & Ras Al Khaimah UAE - For more information please contact our following representatives:

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115