- Jan 28,2022

- All | International Taxation

BEPS 2.0 - Pillar Two - Global Minimum Tax

Building on its work on BEPS 2.0 - focuses on addressing the tax challenges of digitalization of the economy, the OECD/G20 Inclusive Framework released Pillar Two (Global Minimum Tax) Model Rules.

To summarize, one aspect of BEPS 2.0 is the introduction of a global minimum tax (15%) for multinational enterprises (MNEs) with annual revenue of Euro 750 million or more.

BEPS 2.0 – Pillar Two requires MNEs to pay a minimum tax of 15% considering the financials of the Company prepared as per recognized accounting standards. The main components of tax calculation are the Calculation of Profits and the Effective tax rate of each jurisdiction.

The Model Rules

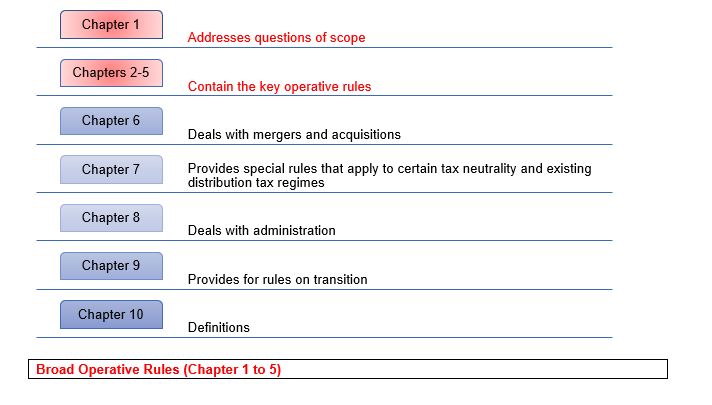

The Model Rules on Global Minimum Tax states the scope and mechanics for the GloBE rules (the two interlocking domestic rules) – Income Inclusion Rule (IIR) and Under tax payment Rule (UTPR)) and contains 10 chapters as listed under:

We discuss herewith the key provisions of scope and charging provisions (broad operative rules) of the Pillar Two of BEPS 2.0:

Chapter One

Clarifies that Pillar Two would not apply to the following:

- Taxpayers that have no foreign presence

- Taxpayers have a foreign presence but have less than EUR 750 million in consolidated revenues.

- Government entities, international organizations, non-profit organizations, and pension funds - regardless of whether they are an Ultimate Parent Entity (‘UPE’)

- Entities that meet the definition of investment or real estate fund - only if they are the UPE of an MNE Group.

Taxpayers in the scope of the rules are required to calculate their Effective Tax Rate(‘ETR’) for each jurisdiction where they operate and pay top-up tax for the difference between their ETR per jurisdiction and Global Minimum rate i.e., 15%.

Chapter Two

Deals with the application and allocation of IIR and UTPR.

Mechanics of the Income Inclusion Rule

- Parent Entity to pay its allocable share of the Top-up Tax with respect to its Low-Taxed Entity.

- If the UPE is not located in a jurisdiction that has implemented the IIR, the highest Parent Entity in the ownership chain that is in a jurisdiction that has implemented the IIR pays its share of the Top-up Tax.

- The exceptional approach in case of split-ownership situations - a Partially Owned Parent Entity applies the IIR in priority over its controlling Parent.

- A Parent Entity’s share of the Top-up Tax is based on its ownership ratio.

Mechanics of the under tax payment Rule:

- Constituent Entities are denied a deduction (or required to make an equivalent adjustment) for the amount of the UTPR Top-up Tax allocated to that jurisdiction.

- The adjustment is applied to the extent possible for the taxable year.

- If the adjustment is insufficient to cover the full amount of the UTPR Top-up Tax for that year, the difference is carried forward for application in a succeeding taxable year.

- The amount of UTPR Top-Up Tax that is allocated to a UTPR jurisdiction = total UTPR Top-Up Tax amount X jurisdiction’s UTPR Percentage.

- A jurisdiction’s UTPR Percentage is determined on the basis of two factors that reflect the relative substance of the MNE Group in each of the UTPR jurisdictions i.e., Employee and Tangible Assets.

- There is a specific carve-out rule to exclude from the applicability of UTPR - if a UTPR Top-up Tax amount allocated to that jurisdiction in the previous year did not result in a corresponding additional cash tax expense.

Chapter Three

This chapter provides the rules for computing the GloBE income or loss of each Entity.

This computation is a central element of the GloBE rules and plays an important role in the ETR calculation.

The computation of the GloBE Income or Loss starts with net income or loss as per consolidated financial statements of the UPE before any consolidation adjustments eliminate intra-group transactions. Then, adjustments are required for, net tax expense, Dividends, Equity Gains or Losses, Gains or Losses on revaluation and disposition of assets, prior period errors, etc.

It is imperative that the transactions between Entities located in different jurisdictions are at the Arm’s-Length Principle and the same transaction amount needs to be recorded in the respective entity’s accounts.

Chapter 3 provide international shipping and ancillary activities. This chapter specifically provides that certain income from international shipping and ancillary activities shall be excluded from GloBE Income or Loss.

Chapter Four

Defines the “covered taxes”

Taxes attributable to the GloBE income or loss of each Entity. This is the second component of the ETR calculation. The definition of covered taxes applies solely for the purposes of the GloBE rules. It also provides specific rules for the allocation of taxes among the entities and mechanisms to address temporary differences.

Chapter Five

Provides rules for the computation of ETR and Top-up Tax for each financial year.

|

ETR = |

the sum of the Adjusted Covered Taxes of each Entity located in the jurisdiction |

|

the Net GloBE Income of the jurisdiction for the Fiscal Year |

Post calculation of ETR for each jurisdiction, the jurisdiction which has ETR below 15% is identified as Low-Tax Jurisdiction, and jurisdictional Top-Up Tax Percentage is computed.

The resulting Top-up Tax of each Low Tax Entity is then charged to a Parent Entity or to Entities located in a UTPR Jurisdiction.

BEPS 2.0 – Pillar Two-Way Forward:

- OECD shall release a Commentary to the GloBE rules in early 2022 that will provide guidance on the interpretation of the global minimum tax rules.

- A model treaty provision to give effect to the Subject To Tax Rule (“STTR”) under Pillar Two will be developed and a Multilateral Instrument will be developed by the IF members by mid-2022.

BEPS 2.0 – Pillar Two - Action Point for Businesses:

- Monitor implementation of the IIR in the home country

- Maintain accounts as per accepted standards and also maintain historical data for the Computation of the GloBE tax base and covered taxes.

- Businesses considering mergers and acquisitions should consider the necessity to maintain historical data and review tax implications

- Review implication on Intergroup transfer of assets and liabilities

- Evaluate whether data system and compliance processes are sufficient to collect significant information on an entity / jurisdictional basis in order to prepare the GloBE Information Return.

How Can We Help?

Our in-house expert tax professionals and our collaboration with AITC - Global Association of Tax Professionals, spread over almost 60 jurisdictions, give us an edge to help your business face the challenge of changing tax landscape.

We shall help you to

- Keep abreast with the latest development concerning the Regulation

- Drafting the financial statements as per the required standards

- Interpret the regulation and analyze its applicability considering your applicable jurisdictions

- Assessing the cross-border and extra-territorial impact of digital economy taxes

- Adhere to the administrative requirements

- Any other queries in respect of the Regulation

International Taxation Support

CA Manu Palerichal

CEO & Partner

+971 – 502828727

manu@emiratesca.com