VAT Refund Scheme for UAE Nationals

VAT Refund for UAE National is a special refund scheme available in the UAE VAT law for supporting the UAE Nationals. There are various VAT Refund Schemes available under the UAE Vat Law wherein even unregistered persons can also get benefit out of it.

Vat Refund Scheme for UAE Nationals is available to those who are building new residences in the UAE. The Federal Tax Authority (FTA) released a user guide on Vat Refund for UAE Nationals for their new residence which offers a detailed procedure to be followed while applying for Refund.

What is the VAT Refund Scheme for UAE Nationals while constructing a new residence?

Construction of a building is a taxable supply under the UAE Vat Law. Hence, when a person constructs even a residential building, he has to pay tax for the expenses incurred during construction which includes building materials, contractor’s bill and many. Under the Vat Refund Scheme for UAE nationals the tax paid for constructing the new residence can be refunded with certain conditions.

The claim can be made by a natural person only and should be a UAE national. A Refund form should be submitted to FTA along with the requested supporting documentation. It should include the details of the applicant and the property. After reviewing the application if found eligible, FTA will provide a reference number to the applicant.

Moreover, additional information can be asked by FTA or a verification body (appointed and authorized by FTA) in order to perform the review of the documents submitted. Once, the final approval comes the eligible amount will be refunded to the applicant.

Eligibility Criteria for VAT Refund for UAE Nationals on New Residences

In order to claim a refund of the VAT incurred on the construction of a residence, the following conditions must be satisfied:

- The applicant should be a natural person who is a UAE national;

- Only for a newly constructed building;

- The building should be solely used as the residence of the person or the person’s family; and

- The claim cannot be made if the building to be used as a hotel, guest house, hospital or for any other purpose not consistent with it being used as a residence by him or his family.

When can one apply for Refund under VAT Refund for UAE Nationals on New Residences?

The application for VAT refund should be submitted to the FTA on any of the events happening first:

- The residence becomes occupied – when the UAE National starts staying in the new residence.

- When it is certified as completed by a competent authority in UAE (as per the Building Completion Certificate).

The applicant should submit the application whichever happens first from the above. However, he should submit the VAT Refund application within 6 months from the date.

Which Costs are eligible for a refund?

The VAT incurred for the following categories of expenses while constructing a new residence by a UAE National are eligible for VAT Refund under the scheme:

Below Content Source: FTA USER Guide

- Services of builders

- Services of architects

- Services of engineers

- Supervisory services

- Other similar services necessary for the successful construction of the residence

- Building materials that make up the fabric of the property (e.g. bricks, cement, tiles, timber)

- Central air conditioning and split units

- Doors

- Decorating materials (e.g. paint)

- Dust extractors and filters

- Fencing permanently erected around the boundary of the dwelling

- Fire alarms and smoke detectors

- Flooring (excluding carpets)

- Guttering

- Other heating systems

- Kitchen sinks, work surfaces and fitted cupboards

- Lifts and hoists

- Plumbing materials

- Powerpoints

- Sanitary units

- Shower units

- Window frames and glazing

- Wiring when embedded inside the structure of the building

Examples of expenses which are not eligible for considering the scheme

- Furniture which is not affixed to the building such as sofas, tables, chairs, bedroom furniture, curtains, blinds, carpets

- Electrical and gas appliances, including cookers

- Landscaping, such as trees, grass and plants

- Free-standing and integrated appliances such as fridges, freezers, dishwashers, microwaves, washing machines, dryers, coffee machines;

- Audio equipment (including remote controls), built-in speakers, intelligent lighting systems, satellite boxes, Freeview boxes, CCTV, telephones

- Electrical components for garage doors and gates (including remote controls)

- Garden furniture and ornaments and sheds

How to submit the VAT Refund Form under the Scheme?

To claim the VAT Refund, you should complete the form available on the FTA website and submit it online, along with copies of supporting documents. It is important that copies of all documentation (i.e. valid tax invoices) supporting the original payment of the VAT are retained in order for the claim to be validated by the FTA.

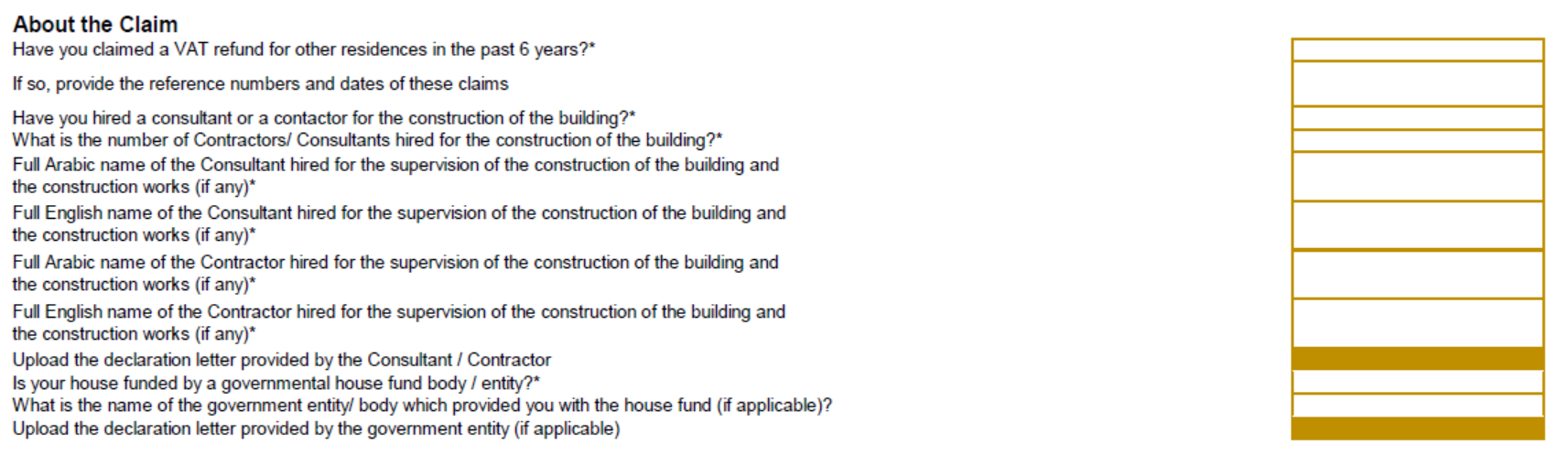

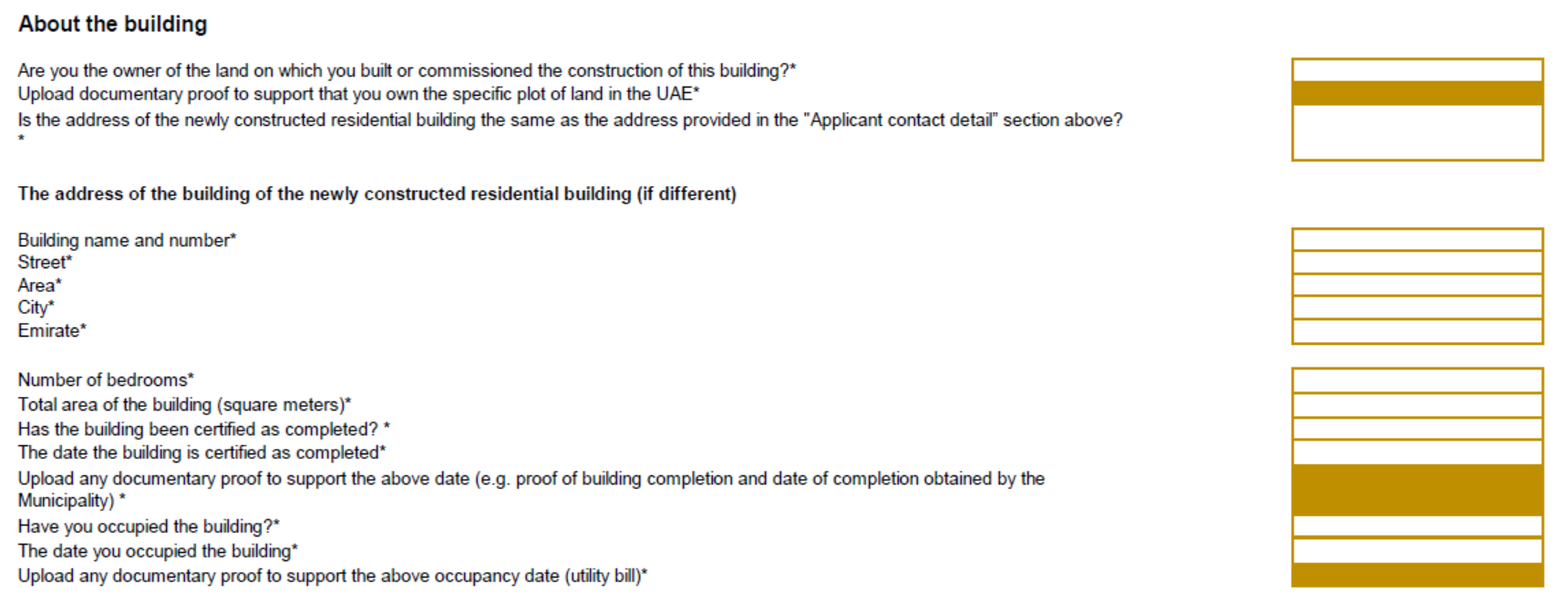

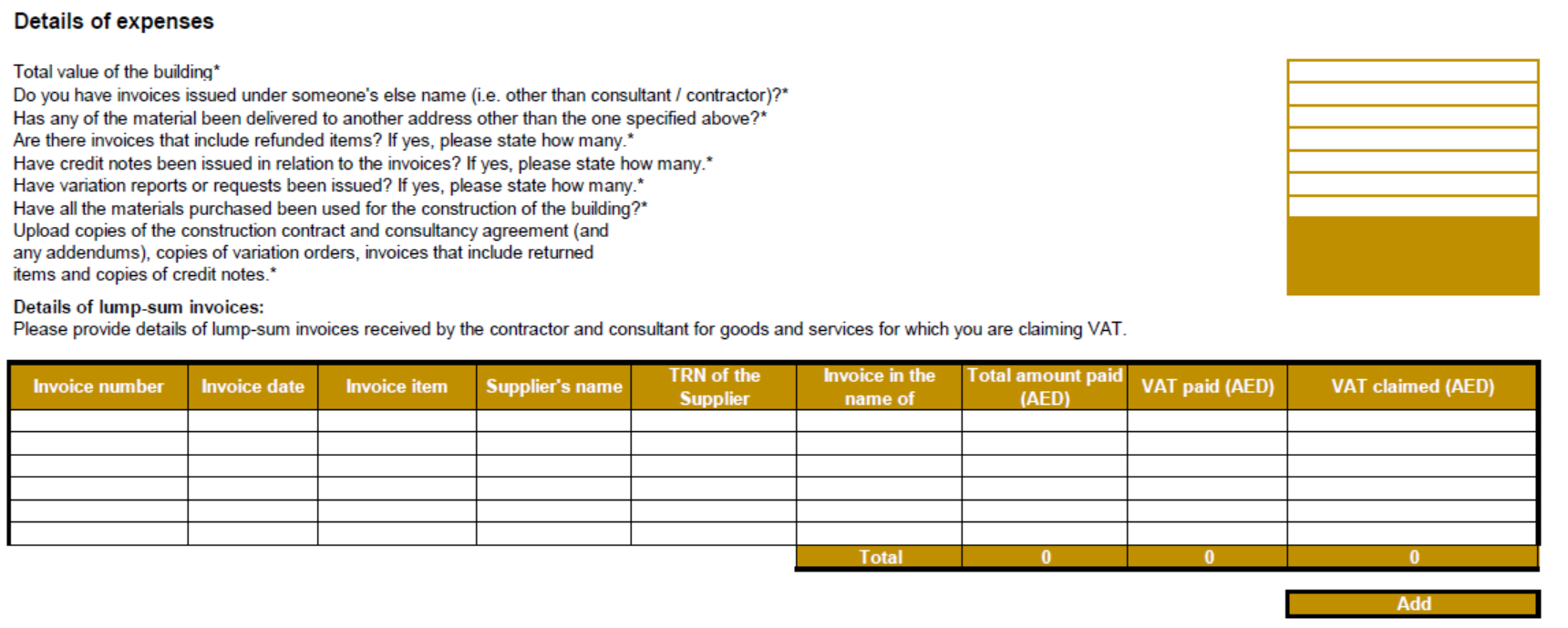

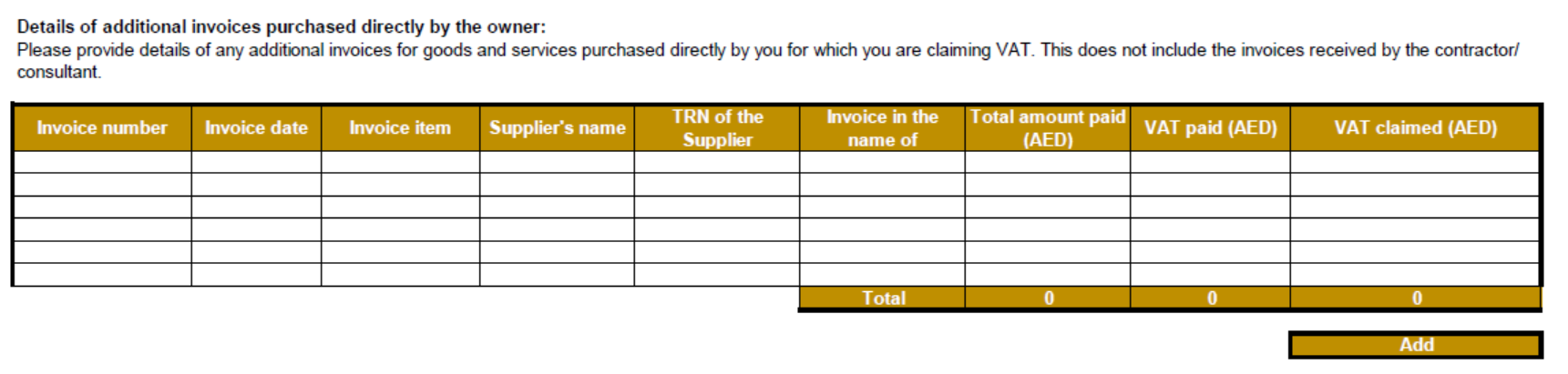

How does the form In the FTA for obtaining the VAT Refund look like?

What you need to do after the Refund Form is completed?

All you need to do after you have completed the Refund Form is, please send the soft copy (signed version in PDF format) to the following email address along with the supporting documents homebuilders@tax.gov.ae

What are the things to be noted while submitting the Refund Form?

- Please note that the FTA will not review New Residences refund requests sent if is sent to any other FTA email addresses other than the above given.

- Accepted file types are PDF, JPG, PNG and JPEG.

- The total file size limit is 10 MB.

- You will obtain an immediate email notification upon successful submission of the Refund Form.

This VAT refund scheme is beneficial to UAE Nationals in order to reduce their expenditure incurred on account of VAT paid while constructing a new residence. As rightly said by FTA Director-General Khalid Al Bustani, this, “in turn, will lead to achieving the vision of our wise leadership to develop a modern, stable housing system in the UAE.”

Looking for any Assistance?

We are here to support It is always advisable to have a detailed verification of the eligible documents before proceeding for submitting the application. VAT Consultants from Emirates Chartered Accountants Group will conduct a detailed VAT Compliance Review before proceeding for submitting your VAT Refund application.

Looking for TAX Services in the UAE? We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Navaneeth

nav@emiratesca.com

+971 – 558892750

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115