Voluntary Disclosure under UAE VAT Law

The Federal Tax Authority (FTA) has introduced a form 211 – VAT voluntary disclosure form recently. It will help the taxable persons to rectify the errors they committed in their UAE VAT Form 201 which is already filed. It is an option given by the FTA for the tax periods to voluntarily disclose the errors one has committed.

What is meant by Voluntary Disclosure under UAE VAT Law?

Every Taxable person has an option to rectify the contents of the VAT Return (Form 201) which were already filed. By using the voluntary disclosure option, the taxable person can rectify the amount of tax disclosed by him previously. One can use the form 211 – VAT voluntary disclosure to inform the authority and rectify the same voluntarily before the authority finds it before a tax audit or through an assessment.

How to use the VAT Voluntary Disclosure Form 211?

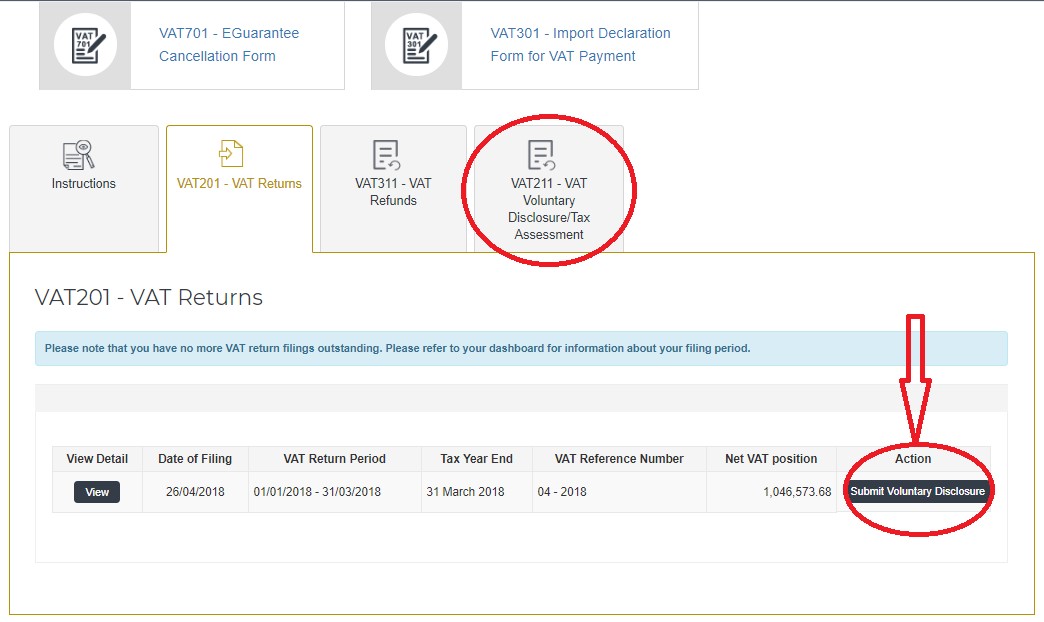

Once the taxable person identifies the error or omission he made in his previous VAT return form 201, he can log in to the official portal of FTA by using their user name and password and access the VAT voluntary disclosure form 211 to rectify.

As shown in the above screen shot, the taxable person can select the respective periods wherein a voluntary disclosure is required by clicking the button submit form 211 to rectify the mistakes.

When can one use VAT Voluntary Disclosure Form 211?

If a taxable person makes an error or omission or a wrong treatment of tax by which the output tax payable or input tax recoverable is more than AED 10,000/- for a particular period then, he must use the VAT Voluntary Disclosure form 211 to inform the authority. The form will show the original figures disclosed under “as reported” and will give an option to edit the amount under separate box named “as the current”. Further, the reason for such discrepancy also should be disclosed.

Once the newly arrived figures are written in the respective boxes under “as current”, the total tax liability under box number 14 also gets changed. This will be the actual tax liability to be paid to the authority. Further, the taxable person should also upload the supporting documents for such voluntary disclosure. It includes a letter describing the background of the facts and a detailed description of the errors disclosed, the reason for voluntary disclosure as well as the impact on the relevant boxes of the tax return.

Penalty while using the VAT Voluntary Disclosure Form 211? There are two types of penalties.

- Fixed penalty

- Percentage based penalty

Fixed penalty –

if the taxpayer uses the VAT Voluntary Disclosure form 211 for the first time, AED 3,000/- shall be levied. For every repetition in using the VAT Voluntary Disclosure form 211 AED 5,000/- shall be charged.

Percentage based penalty –

if the taxpayer discloses less than the actual tax liability in the return and subsequently uses Form 211 VAT Voluntary Disclosure form, the percentage-based penalty will be as follows:

- If the taxable person makes a voluntary disclosure before the authority notifies (by way of tax audit or tax assessment), 5% of the tax amount which was not disclosed earlier will be the penalty.

- If the authority notifies the taxable person for a tax audit and during the tax audit if he makes a voluntary disclosure by using VAT Voluntary Disclosure Form 211, he will be liable to pay 50% of the tax amount.

- If the taxable person makes a voluntary disclosure after the authority notifies for a tax audit but before starting the tax audit, he has to pay 30% of the tax amount as a penalty.

What if the difference in tax amount identified is less than AED 10,000/-?

If a taxable person makes an error or omission or a wrong treatment of tax by which the output tax payable or input tax recoverable is less than AED 10,000/- for a particular tax period, then he need not use the VAT Voluntary Disclosure form 211 to inform the authority. He can rectify such errors in the subsequent VAT Return without a separate disclosure.

For Example:

ABC LLC is a company registered in Dubai and the tax paid is 1st January 2018 to 31st March 2018 and quarterly thereafter. For the first quarter, the total sale was AED 10,000,000/- out of which 3,000,000/- was an export and the balance 7,000,000/- was standard rated supply. The total output VAT is AED 350,000/-. Recoverable input tax under standard rated expenses (5,000,000/-) was AED 250,000/-. Hence, net tax payable is AED 100,000/-.

Suppose, ABC LLC wrongly filed their VAT Return Form 201 - AED 6,000,000/- as 5% taxable supply and AED 4,000,000/- as export. In this case it will be showing AED 50,000/- as net tax payable to the authority.

What will be the penalty under the voluntary disclosure scheme?

- If voluntary disclosure is filed for the first time without any notification from the FTA then fixed penalty is AED 3,000/- and percentage-based penalty will be AED 2,500/- (5% of AED 50,000/-)

- If the authority already sent a notification for a tax audit and if ABC LLC discloses under VAT Voluntary Disclosure Form 211 before the authority starts a tax audit, then the fixed penalty is AED 3,000/- and percentage-based penalty will be AED 15,000/- (30% of AED 50,000/-).

- If the authority already started a tax audit and ABC LLC discloses under the VAT Voluntary Disclosure Form 211 during the tax audit, then the fixed penalty is AED 3,000/- and percentage-based penalty will be AED 25,000/- (50% of AED 50,000/-)

Every taxable person should file their VAT Return with optimum precision within the time frame specified by the UAE VAT Law which is within 28 days from the end of each tax period. A taxable person should ensure that the VAT Return Filing is processed in a correct manner, so as to limit the frequency of using the VAT Voluntary Disclosure Form 211 to avoid penalties.

Emirates Chartered Accountants Group assures best VAT Return Filing Services across UAE. Our Tax Executives can support you by visiting your premises for compliance and compilation of your VAT Return by making sure that your VAT Returns are filed correctly and within the due date.

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115