Register for VAT in the UAE -Complete Guidance

VAT Registration in the UAE For VAT registration in the UAE, an entity should complete an online VAT Registration form which is expected to be available through the Federal Tax Authority online portal by mid-September 2017. The Voluntary Registration can be started in the third quarter of 2017 itself, however, it is mandatory to register in the fourth Quarter. Once the registration is complete, a Tax Registration Number (TRN) will be provided to the applicant.

Matters to be considered and documents required for VAT Registration in the UAE.

Before starting VAT Registration in the UAE, the following points should be considered by the applicant:

1. Are you registering voluntarily or mandatorily? 2. Are you applying for Group registration or as a single? 3. Supporting documents or information required for VAT Registration in the UAE:

a. Trade license b. Certificate of incorporation c. Emirates ID d. Articles of Association e. Bank Account details f. Description of business activities g. Last 12 months turnover h. Projected future turnover i. Expected values of imports and exports j. Expecting any GCC supplies k. Details of Customs Authority Registration

It is advisable to have all the above documents and information in hand before starting the VAT Registration.

Steps for VAT Registration in the UAE

VAT Registration should be done through the FTA Online Portal. Once the registration is open, the steps to be taken to complete the VAT registration are outlined below:

1. Create a new account to log in

a. Provide name and other basic details and set new password b. Verify the email

2. Once login, the user can register for VAT. Complete the registration form and on successful registration, a Tax Registration Number (TRN) will be provided to the user.

Who should register for VAT?

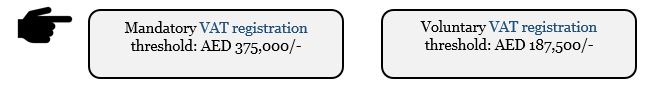

Every taxable person who is a resident in the UAE and whose value of annual supplies in the UAE exceeds or is expected to exceed the mandatory registration threshold will have to register for VAT in UAE. The threshold limits for VAT registration are as follows:

For VAT registration in UAE, the total value of taxable supplies made for the current month and the previous 11 months shall be considered for calculating the annual supplies. Also, the expected value of supplies for the next 30 days will be considered to determine if the annual supplies will exceed the threshold.

No threshold will be considered for a non-resident taxable person (a taxable person without having a fixed establishment) to determine his VAT registration in UAE. Such taxable persons will be required to register mandatorily. Emirates Chartered Accountants Group are the TAX Experts providing VAT Consultancy, VAT Advisory and VAT Implementation Services in the UAE. For more information and VAT registration purposes, please contact our below representatives.

Note: This blog is prepared from the latest information obtained from the discussion/briefing done by the Federal Tax Authority.

Looking for TAX Services in the UAE?

We provide:

- Tax Agent’s Service

- VAT Return Filing

- VAT Service

- VAT Registration

- Excise Tax Service

- VAT Deregistration

For Tax Services in Dubai:

Mr. Pradeep Sai

sai@emiratesca.com

+971 – 556530001

For Tax Services in Abu Dhabi:

Mr. Vinay. E. R

vinay@emiratesca.com

+971 54 378 44140

For Tax Services in Northern Emirate (Sharjah, Ajman, RAK, Fujairah)

Mr. Praveen

praveen@emiratesca.com

+971 – 508873115